Reflects enhanced asset allocation

Enhances the traditional asset-allocation process, which is full of equity risk and rising correlations.

Enhances the traditional asset-allocation process, which is full of equity risk and rising correlations.

Properly places investor goals and needs ahead of “benchmark” performance.

Aims to deliver consistent returns, based on your goals, with less pain: lower losses, less often, and for shorter periods of time.

Provides the foundation for a properly diversified portfolio and reduces the reliance on interest-sensitive, low-return/high-risk investments to protect against expected volatility.

For those seeking a dedicated, thoughtful, sophisticated approach to wealth and investment management.

The Wealth Investment Office works with us to consider the current state of financial markets to weigh the current investment opportunities and risks impacting which can help you achieve your financial goals.

The auto industry is a microcosm for Canada when it comes to concerns over the impact of tariffs. For investors, this is where things get tricky. Tariffs for the auto industry are a big negative for the Canadian economy and jobs. As always, the key to surviving — and thriving — is having a well-diversified, contemporary investment portfolio built around a thoughtful wealth plan, backed by institutional-grade research, and managed by professionals employing active strategies.

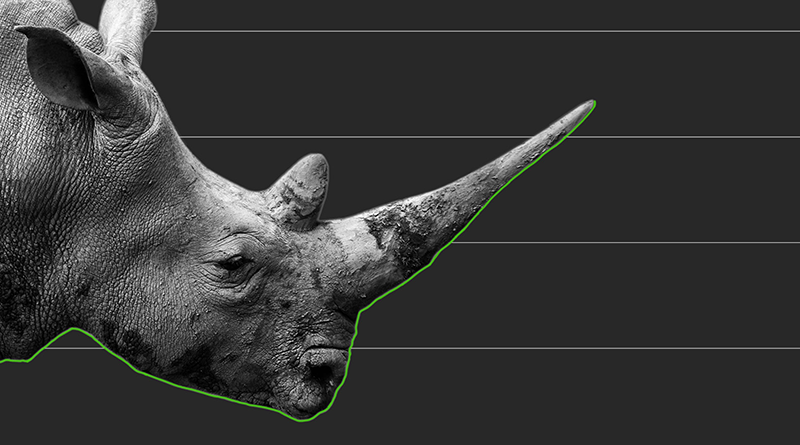

The risks we see coming yet do nothing to avoid (the so-called “Grey Rhinos”) and this headline-driven market often mask the truth about economic conditions, which over the long term underpins financial markets. There’s no doubt we live in turbulent times. We will dig deep with the best of our thinking to take advantage of opportunities and manage risks with a well-diversified, contemporary investment portfolio built and managed around a thoughtful wealth plan. Read on.

Market commentary on the latest quarter focusing on Canadian and U.S. fixed income, and Canadian, U.S and international equities.