Serious Wealth Demands Serious Attention

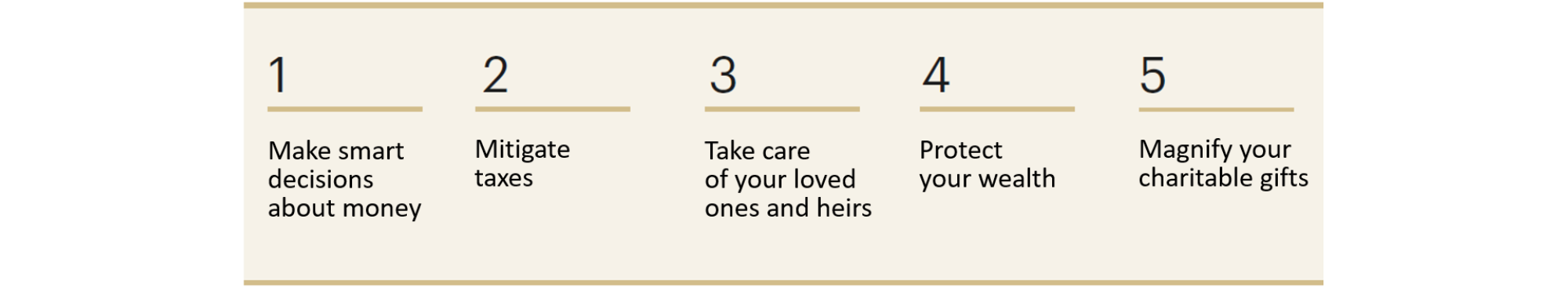

We align each affluent investor’s goals, risk profile and investment strategy to help them address five of their key concerns:

Risk Insight and Return Potential

THAT WAS THEN: Traditional portfolio construction models served investors well in the rear-view mirror despite sharing many of the same risk characteristics.

THIS IS NOW: We need to assess risk factors more astutely.

OUR SOLUTION: Our approach follows a rigorous, institutional-style model that helps us to mitigate market conditions and volatility, combined with our time-tested approach. We formulate a collective view on each asset class, including expected risk-adjusted returns. This informs the customized creation of each client’s portfolio, carefully ensuring each risk factor is met.

Video filmed August 26, 2019.

THIS IS NOW: We need to assess risk factors more astutely.

OUR SOLUTION: Our approach follows a rigorous, institutional-style model that helps us to mitigate market conditions and volatility, combined with our time-tested approach. We formulate a collective view on each asset class, including expected risk-adjusted returns. This informs the customized creation of each client’s portfolio, carefully ensuring each risk factor is met.

Video filmed August 26, 2019.

Our Investment Process

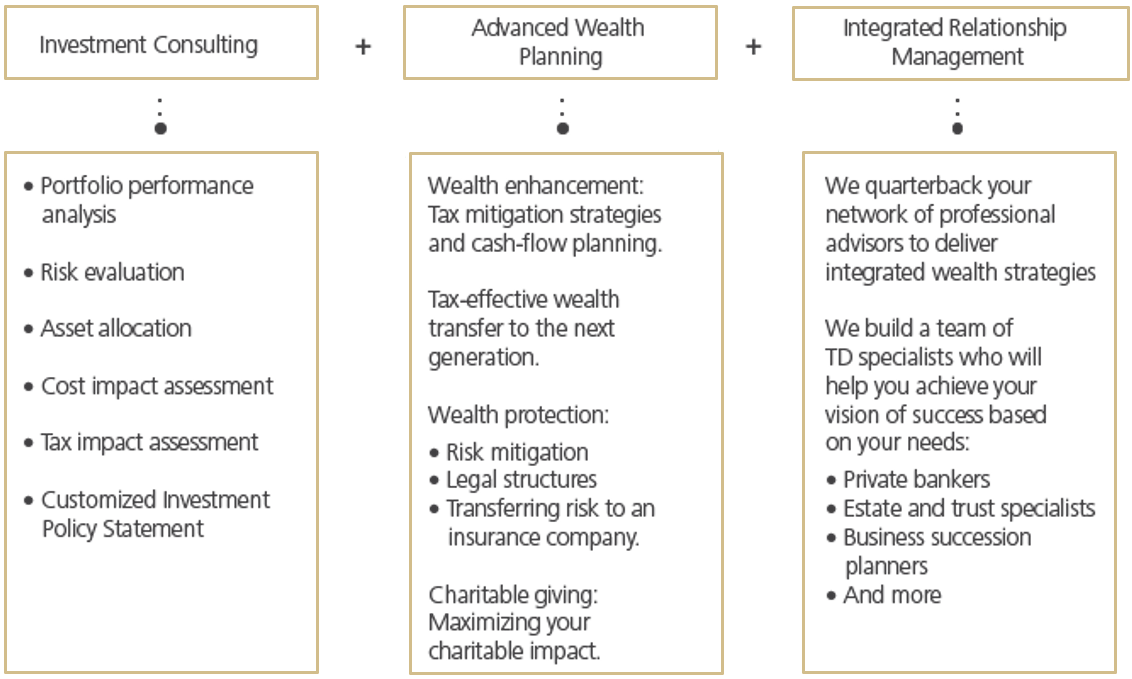

Our Wealth Management Formula

Here’s how we manage wealth elements to help our clients achieve what is important to them: