Newsletters

Following two difficult years, the need for giving continues to grow, in Canada and across the world. For those who would like to make philanthropy a part of their legacy, here are seven key considerations (and surprising tax benefits) you should be aware of.

When interest rates move lower, you may wonder how your finances will be impacted, both now and in the future. What does it mean for people with mortgages, savers or the recently retired? Nicole Ewing, Director, Tax and Estate Planning, TD Wealth, joins Kim Parlee with some ideas to help manage the changing environment.

Leaving a lasting legacy for your family can involve careful planning and a team of professionals. Here are five questions that can help get you started.

With two cuts by the Bank of Canada now on the books, attention is shifting to the upcoming September meeting. Andrew Kelvin, Head of Canadian and Global Rates Strategy at TD Securities, explains why he believes even if a September cut doesn’t happen, the benchmark rate is likely to fall to 4% by the end of the year.

Stepfamilies are common, but planning for who gets what after you die is anything but routine. When families come together, each with their own possessions, ensuring your assets go where you want is key.

There are lots of well-worn thoughts on retirement. Unfortunately, many of these ideas should have been retired a long time ago. Here are some up-to-date ideas on how you should approach retirement.

Too many Canadians are dying without a Will, leaving children, heirs and assets in limbo. Here’s why you should consider writing your own will today.

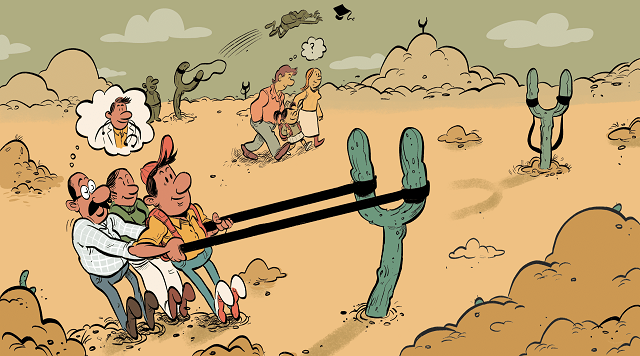

A doctor? A lawyer? Maybe a software engineer? Who knows what path your child may pursue. We break down the economics of some popular career paths so you can ask: How can I help?

If retirement is on the horizon, but it feels like there's still so much to do, feel free to take a breath. This checklist may help alleviate some of your worries.