Mark-Henry Chau

Phone

Office Location

Mark-Henry has built his career in the financial services industry over the past 15 years. He is an avid golfer and is committed to an active lifestyle.

When he is not at work or on the golf course, he devotes his time to philanthropy and community service. He is a past president and current fundraising chair for the Rotary Club of Old Montreal. For his dedication to the community, he was chosen as a finalist in 2021 by Wealth Professional Canada for the award for "philanthropy and community service".

Mark-Henry graduated from the John Molson School of Business with distinction. He made the Dean's list through 2006-2008. He also holds the Chartered Investment Manager designation.

As an Associate Portfolio Manager and Senior Investment Advisor, he helps families, individuals, and organizations manage through life's many important milestones and unexpected situations, striving to bring security and prosperity to people's lives. His goal is to act as your chief financial officer, guiding you to make wise and well-informed decisions to achieve your vision of success.

This is made possible through TD specialists with backgrounds in portfolio management, accounting, law, notaries, trusts, estate planning, and more, all with the expertise to provide you with the proper advice.

When he is not at work or on the golf course, he devotes his time to philanthropy and community service. He is a past president and current fundraising chair for the Rotary Club of Old Montreal. For his dedication to the community, he was chosen as a finalist in 2021 by Wealth Professional Canada for the award for "philanthropy and community service".

Mark-Henry graduated from the John Molson School of Business with distinction. He made the Dean's list through 2006-2008. He also holds the Chartered Investment Manager designation.

As an Associate Portfolio Manager and Senior Investment Advisor, he helps families, individuals, and organizations manage through life's many important milestones and unexpected situations, striving to bring security and prosperity to people's lives. His goal is to act as your chief financial officer, guiding you to make wise and well-informed decisions to achieve your vision of success.

This is made possible through TD specialists with backgrounds in portfolio management, accounting, law, notaries, trusts, estate planning, and more, all with the expertise to provide you with the proper advice.

Chau & Associates Wealth Management is a part of TD Wealth Private Investment Advice, a division of TD Waterhouse Canada Inc. which is a subsidiary of The Toronto-Dominion Bank.

Certificates

B.Comm.

CIM®

Languages

French

English

Education

John Molson School of Business

Community Involvement

The West Island Lion's Club

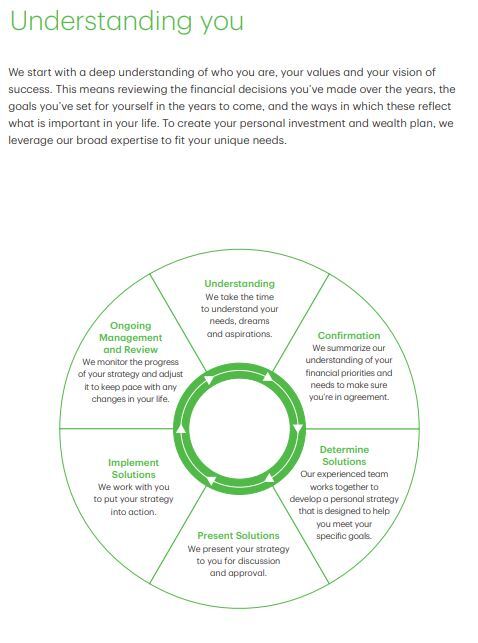

Helping achieve what truly matters to you and your family.

Our wealth solutions focus on four key areas in order to ensure you receive a personalized wealth plan you can feel confident in.

Build net worth: We can help you build your net worth by developing effective strategies and investment solutions that align to your needs, even as they evolve.

Protect what matters: By leveraging the expertise of TD specialists, we can integrate strategies to help you protect what matters to you most at every life stage.

Implement tax-efficient strategies: We can work with you to help create and structure your accounts to help reduce tax exposure while keeping income available for when you need it.

Leave a legacy: Your legacy is important to us. We’ll help you create a plan that provides for your top priorities and optimizes the transfer of your wealth.

Build net worth: We can help you build your net worth by developing effective strategies and investment solutions that align to your needs, even as they evolve.

Protect what matters: By leveraging the expertise of TD specialists, we can integrate strategies to help you protect what matters to you most at every life stage.

Implement tax-efficient strategies: We can work with you to help create and structure your accounts to help reduce tax exposure while keeping income available for when you need it.

Leave a legacy: Your legacy is important to us. We’ll help you create a plan that provides for your top priorities and optimizes the transfer of your wealth.

What We Do

What to expect when working with us

Tabs Menu: to navigate this menu, press tab and use the left & right arrow keys to change tabs. Press tab to go into the content. Shift-tab to return to the tabs.

Portfolio Management

Retirement Planning

Tax Planning

Will and Estate Planning

Our Clients

You've worked hard to get where you are today. Now's the time to maintain, grow, and protect your net worth. Get tailored advice, solutions, and strategies that can help achieve your goals.

Trending Articles

Stay informed and enhance your investment knowledge with our curated articles on the latest news, strategies and insights.

Money Mismatch: 4 ideas to manage your money and your relationship

Article

Money Mismatch: 4 ideas to manage your money and your relationship

More than half of Canadians surveyed say they would break up over a partner's spending habits. Here's why some planning and flexibility can be the foundation of a great money partnership.

2026 resolutions: 4 things you can do now to improve your fiscal fitness

Article

2026 resolutions: 4 things you can do now to improve your fiscal fitness

Starting the new year on the right foot, financially, may be easier than you think. Are you ready to strengthen your wealth building muscle? Here are four ways to get your money doing some of the heavy lifting.

3 questions snowbirds should ask before taking flight

Article

3 questions snowbirds should ask before taking flight

The annual migration may look a little different for Canadian snowbirds this year. Whether you're still planning or already packing, here are three items to double-check before heading abroad for an extended period.