Newsletters

AI-driven disruption is forcing a painful re-pricing in software, exposing concentration risk and reshaping the next phase of equity leadership. The current sharp correction in software and Big Tech is exactly the kind of market “reset moment” we explored in our latest Portfolio Strategy Quarterly, “The Brand New Renaissance”. Our belief is that we are in an era where the speed of change will be exponential and compounding and that 2026 will be a critical year, when markets will forcefully re-price areas that are susceptible to the change that AI will bring.

In every direction, the investment landscape is being pulled out of the laboratory and into the real economy. Either the economy proves to be resilient and earnings will benefit, or the economy will stagnate and investors will lose their patience with hyped-up promises. Either way, the coming year will tell the story. As always, the important thing is not to predict the correct outcome, but to hold a portfolio that can withstand any outcome — one diversified by risk factor and by traditional asset class, as well as incorporating a broad spectrum of alternatives. Read on to see how we will be framing the year ahead as we utilize our Wealth Strategy Process to guide and manage portfolios in 2026

The case for diversification has never been stronger. While the U.S. has been and remains a force of innovation and economic stability, investors must be cognizant of the increased concentration risk.

By Mansi Desai, Portfolio Manager, Equities

Parents and grandparents who want to teach young kids about generosity may not always know where to start. Kim Parlee speaks with Duke Chang, President and CEO, CanadaHelps, and Jo-Anne Ryan, Vice President, Philanthropic Advisory Services, TD Wealth, and Executive Director of the Private Giving Foundation, about some ways you can encourage acts of kindness early on and as the children grow up.

Hedge funds, when curated right, play an important role in a multi-asset portfolio to enhance return while lowering total portfolio risk. As soon as investors add a second hedge fund strategy to their allocation, they face a choice, sometimes without being aware, as to whether they should adopt a multi-strategy or a multi-manager model. In this paper, we seek to uncover the

fundamental differences between the two approaches.

Giving to charity can make you feel good. Donating while minimizing tax can maximize the impact and make you feel even better.

As investors and issuers of capital navigate the constantly changing headlines, how does the market look past headlines and remain resilient? In this episode, we take a deep dive into international debt capital markets. Laura O'Connor joins Susan Thompson to explore the opportunities ahead of our clients in debt capital markets. We discuss key developments impacting the global industry and address how investment grade markets have adapted to elevated volatility in the market this year. What is behind this?

The Tariff war has been reignited post July 9th. Yesterday, the Trump administration announced a 35% tariff that marks a dramatic escalation in U.S.–Canada trade tensions with potentially serious impact on prices, supply chains, and diplomatic relations. The window to negotiate exemptions or to work out a broader deal is narrow—just a few weeks before the August deadline.

It is challenging to gauge market reaction to headline risk, however, there is no doubt that the risk of increased volatility remains elevated. In environments of elevated uncertainty and volatility, we are even more focused on evaluating what we do know and avoiding an overreaction to what we don’t.

The day has come. Warren Buffet has officially announced his retirement from Berkshire Hathaway at the spry age of 94. For many, Buffet was the entry point into investing – his words of wisdom often forming the backbone of countless portfolio philosophies. As he once said, "Someone is sitting in the shade today because someone planted a tree a long time ago." For the investing world, his legacy is that shade.

This edition of Monthly Perspectives shares a unique firsthand reflection from Nana Yang, Senior Equities Analyst at the Wealth Investment Office, who attended the Berkshire's 60th anniversary annual general meeting in Omaha. Her takeaways from the experience offer not only a tribute to Buffet's remarkable career, but lasting insights on long-term investing, and the enduring power of staying in the game. Read On.

How will tariffs impact Canadian Banks? Many factors could come into play, the most important of which are breadth and duration of tariffs and actions taken by Canadian governments to soften the blow for households and businesses

There’s a lot to think about if you’re a Canadian citizen looking to sell a property in a foreign country. To sell a residence in the United States, there are also tax rules on both sides of the border to plan for. Greg Bonnell speaks with Nicole Ewing, Principal, Wealth Planning Office, TD Wealth about how that can affect the net proceeds of your U.S. property sale.

In this issue of Market Insights, we consider the current market correction through the following four lenses:

1. Amygdala hijacking:

Knowing that the innate desire to flee can come at a high and permanent cost.

2. Extreme social media:

There’s lots of technology out there designed to inflame your biggest fears.

3. Market and economic context:

The market crisis has been less intense than others in recent history, and countries with the

biggest economies are going into this in pretty good shape.

4. Event-driven bear markets:

No one wants a bear market, but if you have to have one, this is the best kind.

The value of a company’s stock stems in large part from its ability to compound earnings growth. That’s why we try to identify broad secular industry trends that will drive multi-year growth for the company. These thematic opportunities help us narrow our selection to a pool of growth compounders that are set to outperform the wider market.

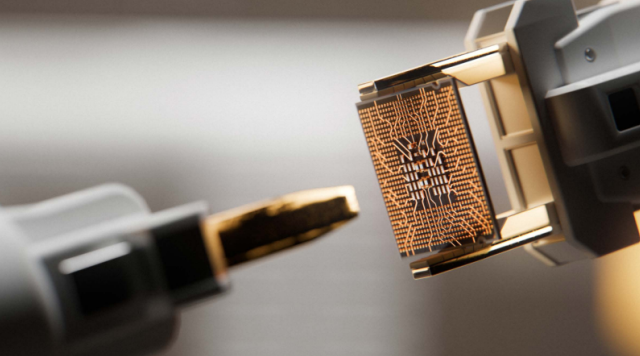

In past Market Insights, that focused on Artificial Intelligence, we looked at the democratization of GenAI productivity and how the “data layer” cohort of software companies are well-positioned to benefit because they manage and process the data, which are the key ingredients in the process. We now turn our attention to the semiconductor supply chain.

The value of a company’s stock stems in large part from its ability to compound earnings growth. That’s why we try to identify broad secular industry trends that will drive multi-year growth for the company. Like the advent of the internet, the adoption of generative artificial intelligence (GenAI) promises to deliver productivity gains across the economy. Both of these represent a breakthrough underlying technology that allows workers to become more efficient in their everyday tasks.

No more pundits, attack ads or mudslinging. Goodbye polls and blessedly, good riddance to betting markets and political sentiment driving markets - it's back to business. In the short-term markets are driven by sentiment, while in the long run markets are driven by something you can measure and account for - financial results.

Now that we know Donald Trump will be the next President of the United States, what does it mean for financial markets? Are interest rates headed higher? What does this mean for equity markets? What about other assets and global impact?

Taken in isolation, the performance of the six largest Canadian banks (the Big 6) has been solid this year, with their stocks up 34% since the October 2023 bottom. However, there are a couple of observations that should be brought forward.

Over the past decade we have been on quite the investment management journey together — one that has challenged the orthodoxy of the 60/40 portfolio. Instead, recognizing certain deficiencies in the typical “balanced” portfolio, we have favoured an adaptive approach to investment strategy and an enhanced approach to asset allocation.

Today we call this approach the TD Wealth Strategy Process, and one of the major differentiators has been the inclusion of “alternative” investments, like hedged strategies, private capital, commodities, currencies and real assets.

In this special edition of Perspectives, we have tasked two of our best analysts, Shezhan Shariff and Neelarjo Rakshit, with shedding light on Private Capital, the lesser-known of these asset classes. Read on.

Canadian banks have been plagued by weak underlying fundamentals for the last two years: high expense growth and lower capital markets related revenue (CMRR) offset the benefit of rising rates. This resulted in several quarters of negative operating leverage that, combined with the normalization in credit losses, has weighed on the stock performance of Canadian banks.

However, Q2 marked the first quarter of positive operating leverage, which was driven by improving revenue growth and slowing expense growth (from last year’s cost initiatives and moderating inflation). Read on for more on our perspective on Canadian Banks.