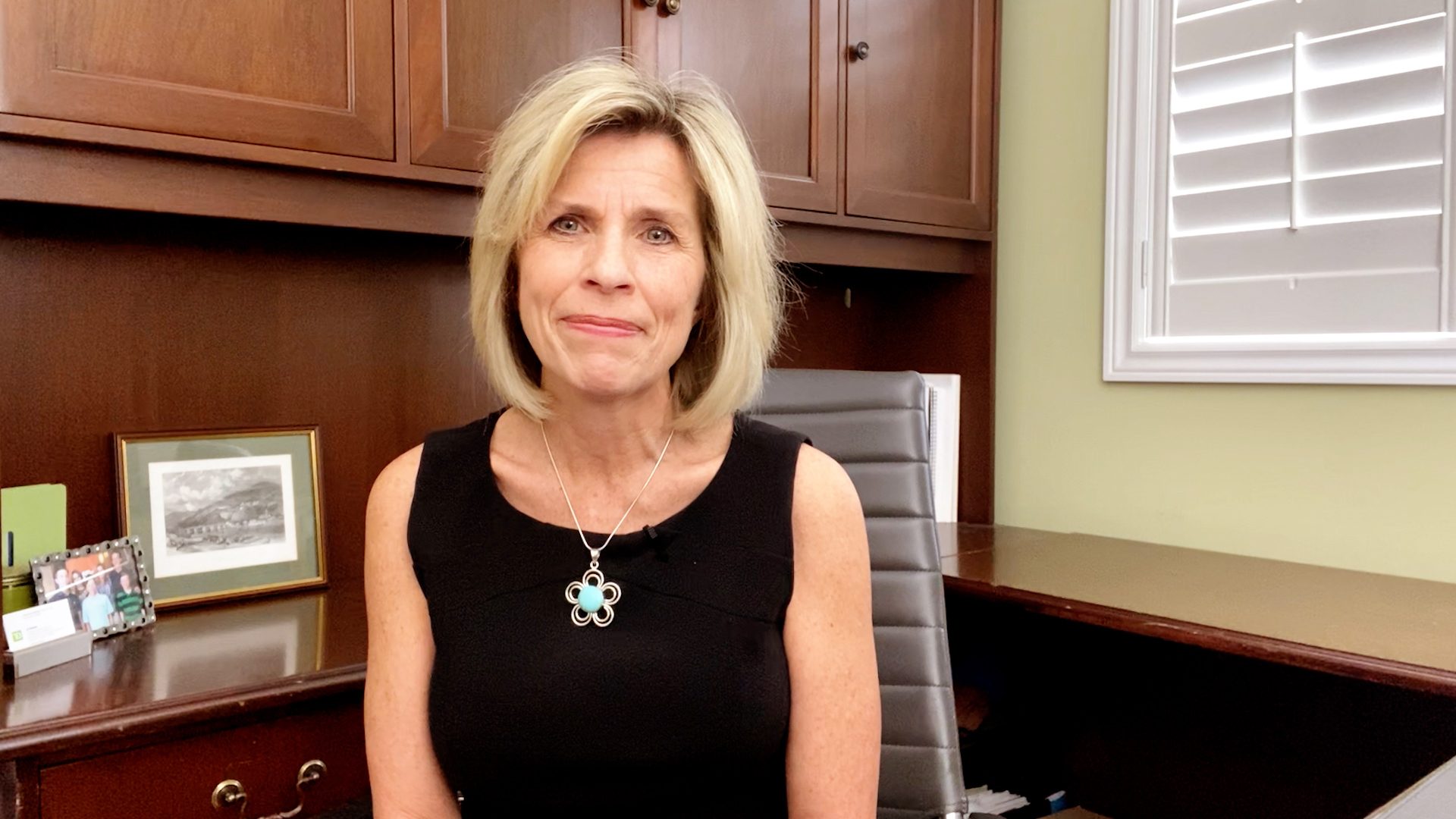

Lea-Anne Barker

Phone

Office Location

BACKGROUND | With over 20 years' experience as a finance professional, I provide a comprehensive and disciplined approach to wealth management. As a holder of both the Chartered Financial Analyst (CFA®) and Chartered Professional Accountant (CPA, CA) designations, my professional background provides me with a unique perspective on the industry. I deliver my clients wealth plans that are informed by in-depth knowledge of investment management, technical & financial analysis, as well as effective tax and estate planning strategies.

Certificates

CFA

CA

Languages

English

French

Education

B.Comm

Have questions about your financial future?

Click on the titles below to watch more videos from Lea-Anne about wealth planning, stepping into retirement and a legacy toolkit.

Wealth Planning

We all have financial questions at one point or another. Are my finances in good shape? Will I have enough money for retirement? Whatever your personal situation is, it can be important to have a plan.

Stepping Into Retirement

For many, a happy retirement is the ultimate life goal—a time to do all the things you've always wanted. Yet, the excitement of this new chapter can bring a touch of anxiety and hesitation because, let's face it, retirement is a significant life change.

A Legacy Toolkit

Nothing gets built properly without the right tools. The same can be said for building a legacy. If you want to commit your money to the next generation after you pass away, your finances need to be managed with care and precision.

Your Goals, Our Priorities

We'll help you identify your priorities and create a plan to address your specific needs. We can help with:

- Protecting your assets

- Maximizing your charitable giving

- Finding tax strategies and solutions

- Arranging your estate and trust planning

Helping achieve what truly matters to you and your family.

Build net worth: We can help you build your net worth by developing effective strategies and investment solutions that align to your needs, even as they evolve.

Protect what matters: By leveraging the expertise of TD specialists, we can integrate strategies to help you protect what matters to you most at every life stage.

Implement tax-efficient strategies: We can work with you to help create and structure your accounts to help reduce tax exposure while keeping income available for when you need it.

Leave a legacy: Your legacy is important to us. We’ll help you create a plan that provides for your top priorities and optimizes the transfer of your wealth.

Our Services

Investment Planning

Transfer of Wealth

Will and Estate Planning

Retirement Planning

Tailored Solutions

Your unique goals

You've worked hard to get where you are today. Now's the time to maintain, grow, and protect your net worth. Get tailored advice, solutions, and strategies that can help achieve your goals.

Trending Articles

Stay informed and enhance your investment knowledge with our curated articles on the latest news, strategies and insights.

Estate planning basics

Article

Estate planning basics

An estate plan can help ensure your wishes are fulfilled if you become incapacitated and when you pass away. Here’s what you should know about building one.

Buying a home on your own: Ideas for a challenging market

Article

Buying a home on your own: Ideas for a challenging market

Despite ongoing affordability issues, almost half of first-time homebuyers say they want to apply for a mortgage on their own. If you're one of them, here are a few ideas to help you get started.

Mark Carney leads Liberals to victory: Now what?

Article

Mark Carney leads Liberals to victory: Now what?

Mark Carney and his Liberal Party have won a fourth term in Canada’s federal election. The new Carney-led government will take the helm amid ongoing political and economic uncertainty. MoneyTalks’ Kim Parlee speaks with Frank McKenna, Deputy Chair, Wholesale Banking at TD Bank Group and Beata Caranci, Chief Economist with TD, about the election results, relations with the U.S., and the road ahead for Canada’s economy.