Long Term

For investors, it is often said that diversification is the only free lunch. To be sure, this sentiment is one of the investment industry's favorite slogans, and for good reason. Diversification can offer many important benefits. However, of all the things you can do to stack the odds of successful investment outcomes in your favour, we believe that having a long-time horizon is by far the most important variable, not the level of diversification in your portfolio.

This theme has come up several times in previous posts – Lou and I generally insist that our clients only take risk with money that can be invested for the long term. Recall our core-surplus framework, which encourages clients to set any funds aside in risk-free solutions that are needed sooner rather than later. For clarity, I figure it is important to discuss why and to lay out how long is long enough, in our view.

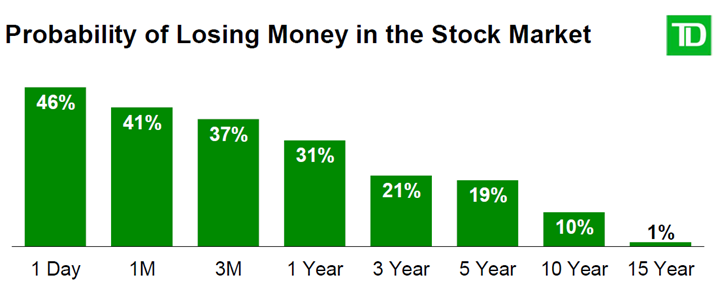

Here is a chart that I love to reference :

Source: TDAM. Factset. Calculation based on S&P 500 Price Returns from Dec 31, 1929 to Aug 31, 2020.

We believe this lays it out quite clearly: Setting out with a short time horizon with your risk-on, or surplus, capital is more akin to gambling than investing. On any given day, there is nearly a fifty-fifty chance that investors will lose money. Over a twelve-month period, there is a thirty-one percent chance and over a five-year window there is still nearly a twenty percent chance of losing money. These are not favourable odds and for many clients not a comfortable outlook for their life savings.

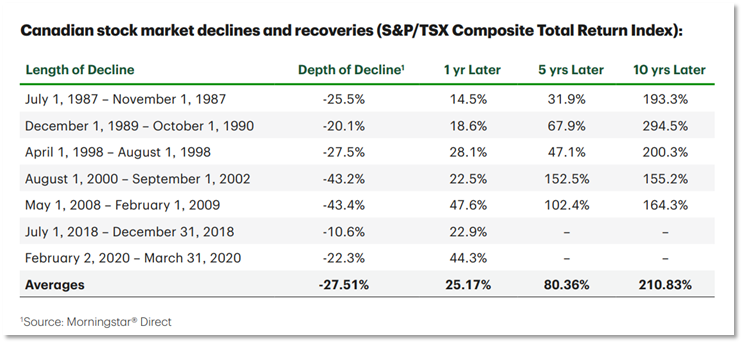

Here is some more data to consider:

This table shows how long it has taken Canadian equity investors to recoup their money after large declines. For example, after the 2008-2009 pullback, investors had to wait nearly five years for their portfolio to recover. Thus, we see that an investor should have at least a five-year time horizon with the money being put at risk, though we prefer more. We have a big imagination when it comes to the potential downside. Future recoveries may take more or less time to play out than those highlighted above. As such, we encourage clients to do everything possible to put time on their side. It is, in our mind, the best chance any of us have as investors.

To be clear, with your risk-on assets – your surplus capital – we believe you should always have at least a ten-year investment horizon. We believe that this constraint needs to be front and centre in every investment discussion. To us, it is the most important variable to consider.

As mentioned previously, Lou and I are currently expanding our practice. If you would like to learn more about our advisory process, please reach out.

To be clear, with your risk-on assets – your surplus capital – we believe you should always have at least a ten-year investment horizon. We believe that this constraint needs to be front and centre in every investment discussion. To us, it is the most important variable to consider.

As mentioned previously, Lou and I are currently expanding our practice. If you would like to learn more about our advisory process, please reach out.

®© 2024 Morningstar is a registered mark of Morningstar Research Inc. All rights reserved.

The information contained herein has been provided by Fry Ormerod Wealth Advisory Group , TD Wealth Private Investment Advice and is for information purposes only. The information has been drawn from sources believed to be reliable. Graphs and charts are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual's objectives and risk tolerance. Certain statements in this document may contain forward-looking statements (“FLS”) that are predictive in nature and may include words such as “expects”, “anticipates”, “intends”, “believes”, “estimates” and similar forward-looking expressions or negative versions thereof. FLS are based on current expectations and projections about future general economic, political and relevant market factors, such as interest and foreign exchange rates, equity and capital markets, the general business environment, assuming no changes to tax or other laws or government regulation or catastrophic events. Expectations and projections about future events are inherently subject to risks and uncertainties, which may be unforeseeable. Such expectations and projections may be incorrect in the future. FLS are not guarantees of future performance. Actual events could differ materially from those expressed or implied in any FLS. A number of important factors including those factors set out above can contribute to these digressions. You should avoid placing any reliance on FLS.

Index returns are shown for comparative purposes only. Indexes are unmanaged and their returns do not include any sales charges or fees as such costs would lower performance. It is not possible to invest directly in an index.

TD Asset Management operates through TD Asset Management Inc. in Canada and through TDAM USA Inc. in the United States. Both are wholly-owned subsidiaries of The Toronto-Dominion Bank.

Fry Ormerod Wealth Advisory Group is part of TD Wealth Private Investment Advice, a division of TD Waterhouse Canada Inc. which is a subsidiary of The Toronto-Dominion Bank.

All trademarks are the property of their respective owners.

®The TD logo and other TD trademarks are the property of The Toronto-Dominion Bank or its subsidiaries.

The information contained herein has been provided by Fry Ormerod Wealth Advisory Group , TD Wealth Private Investment Advice and is for information purposes only. The information has been drawn from sources believed to be reliable. Graphs and charts are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual's objectives and risk tolerance. Certain statements in this document may contain forward-looking statements (“FLS”) that are predictive in nature and may include words such as “expects”, “anticipates”, “intends”, “believes”, “estimates” and similar forward-looking expressions or negative versions thereof. FLS are based on current expectations and projections about future general economic, political and relevant market factors, such as interest and foreign exchange rates, equity and capital markets, the general business environment, assuming no changes to tax or other laws or government regulation or catastrophic events. Expectations and projections about future events are inherently subject to risks and uncertainties, which may be unforeseeable. Such expectations and projections may be incorrect in the future. FLS are not guarantees of future performance. Actual events could differ materially from those expressed or implied in any FLS. A number of important factors including those factors set out above can contribute to these digressions. You should avoid placing any reliance on FLS.

Index returns are shown for comparative purposes only. Indexes are unmanaged and their returns do not include any sales charges or fees as such costs would lower performance. It is not possible to invest directly in an index.

TD Asset Management operates through TD Asset Management Inc. in Canada and through TDAM USA Inc. in the United States. Both are wholly-owned subsidiaries of The Toronto-Dominion Bank.

Fry Ormerod Wealth Advisory Group is part of TD Wealth Private Investment Advice, a division of TD Waterhouse Canada Inc. which is a subsidiary of The Toronto-Dominion Bank.

All trademarks are the property of their respective owners.

®The TD logo and other TD trademarks are the property of The Toronto-Dominion Bank or its subsidiaries.