Newsletters

This week I want to talk about an interesting topic which seems to be gaining serious traction in finance: tokenization. A powerful innovation that's quietly reshaping how we invest.

Tokenization refers to converting real-world assets like stocks, ETFs, or real estate into digital tokens using blockchain technology. This technology allows for 24/7 trading of traditionally illiquid or unlisted assets, eliminating many of the inefficiencies tied to legacy systems and market hours. It has the potential to become a key step toward building a more open, transparent, and accessible financial ecosystem.

Industry leaders are taking notice. BlackRock CEO LarryFink has described tokenization as "the next generation for markets," and the firm is actively investing in the infrastructure to support it. Companies like Robinhood is also pushing ahead—introducing an event in Europe to launch tokenized stocks, as regulatory environments are more welcoming, while U.S. restrictions still limit similar offerings domestically.

But signs of changing are emerging in the U.S. The SEC is considering streamlining ETF approvals. And U.S. Congress is hosting "CryptoWeek" during the week of July 14th, 2025, pushing for legislation that supports the growth of crypto-related financial products. These combined efforts hint at a regulatory pivot that may finally align policy with technological advancement.

It seems like tokenization is becoming more than a trend – this might be a foundational shift that could reshape capital markets.

At TD Wealth Private Investment Advice:

• Our team constructs tailored investment portfolios for high-net-worth individuals with investable assets over $1 million.

• We also help business owners establish corporate investment accounts, as well as manage endowment funds and trust accounts.

Please visit my website https://lnkd.in/gWKHZ8Rd or email me at davidb.lee@td.com to start the conversation.

This week, I want to talk about OBBBA (the One Big Beautiful Bill Act), which was passed by the U.S. House of Representatives following the Senate’s approval just days earlier—and how this change might impact the U.S. economy.

At the core of the bill is a plan to gradually lower corporate tax rates over the next few years. The idea is to stimulate domestic investment and encourage American companies to bring overseas profits back home. Of course, the bill hasn’t come without opposition—amid concerns over the planned reduction in government subsidies for green energy and changes to healthcare benefits. Still, supporters hope this move will make the U.S. more competitive on a global scale and help drive long-term economic growth.

Looking beyond the bill, market sentiment remains cautiously optimistic. Tom Lee from Fundstrat recently shared his positive outlook for the second half of the year. One key reason he points to is the potential return of institutional capital to U.S. equities. During the heightened volatility in the first half, many institutional investors reallocated funds to markets outside the U.S. As that uncertainty subsides, we could see a meaningful flow of capital back into U.S. stocks—and I tend to agree.

We’re not yet seeing signs of excess leverage, housing market overheating, or growing credit risk—factors that often signal late-cycle dynamics. Meanwhile, expectations for rate cuts by the Federal Reserve continue to support liquidity in the system.

As I have mentioned in many of my previous articles, I continue to emphasize one thing: Now is the time to look ahead and position for the next 5years. Staying invested, focused, and forward-looking has never been more important.

At TD Wealth Private Investment Advice:

• Our team constructs tailored investment portfolios for high-net-worth individuals with investable assets over $1 million.

• We also help business owners establish corporate investment accounts, as well as manage endowment funds and trust accounts.

Please visit my website https://lnkd.in/gWKHZ8Rd or email me at davidb.lee@td.com to start the conversation.

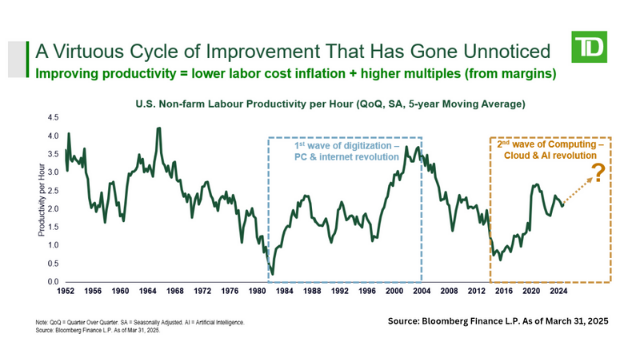

Last week, I had the opportunity to attend a meeting with TD Asset Management. One of the presentation slides particularly resonated with me, and I'd like to share it with you this week.

As I often tell our clients, we are at the early stages of the 4th Industrial Revolution. The current market cycle reminds me of what we experienced during the 1980s and 1990s with the rise of the PC and Internet—what we now call the first wave of digitization.

Today, we are witnessing the beginning of the Second Wave Of Computing—driven by cloud technology and artificial intelligence. The pace at which AI and robotics are evolving is staggering, and this revolution likely has the potential to create an even more powerful wave of innovation than what we saw decades ago.

While there's a lot of noise in the market around geopolitical risks, I continue to emphasize one thing: Now is the time to look ahead and position for the next 5years. As I have mentioned in many of my previous articles, the choices we make today will define our ability to benefit from the structural changes underway. Staying invested, focused, and forward-looking has never been more important.

At TD Wealth Private Investment Advice:

• Our team constructs tailored investment portfolios for high-net-worth individuals with investable assets over $1 million.

• We also help business owners establish corporate investment accounts, as well as manage endowment funds and trust accounts.

Please visit my website https://lnkd.in/gWKHZ8Rd or email me at davidb.lee@td.com to start the conversation.

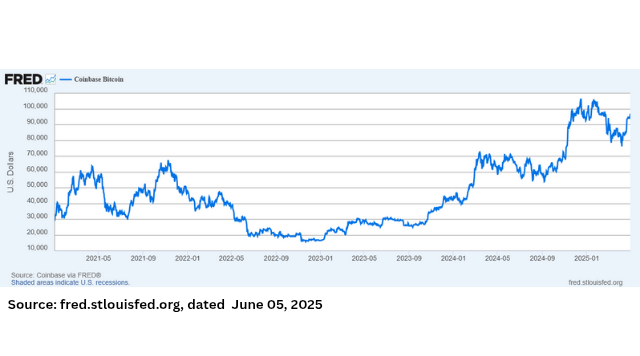

In recent weeks, the M2 Money Supply — a key measure of liquidity in the financial system — has been increasing noticeably. This rise in available cash is now flowing into risk assets, especially stocks and crypto currencies.

Bitcoin, in particular, tends to move in line with M2 growth. When there is more liquidity in the system, investors often look for higher-return opportunities, and digital assets have historically been major beneficiaries.

While short-term volatility may increase due to recent headlines involving figures like Donald Trump and Elon Musk, it is important to stay focused on the bigger picture.

We are now standing at the doorstep of the 4th Industrial Revolution, led by AI. This is not just a passing trend — it marks a profound shift in how industries operate, innovate, and grow. The investment opportunities this transformation will create are expected to be significant and long-lasting.

In this environment, long-term investors should remain steady and intentional. Rather than being swayed by short-term noise, this is a time to gradually build exposure to sectors and ideas that are aligned with the future. The path ahead is being shaped today, and those who position themselves early are most likely to benefit.

Now is the time to look ahead and position for the Next 5years. The choices we make today will define our ability to benefit from the structural changes underway. Staying invested, focused, and forward-looking has never been more important.

At TD Wealth Private Investment Advice, I can help you build your portfolio strategically to align with long-term opportunities.

Please visit my website https://lnkd.in/gWKHZ8Rd or email me at davidb.lee@td.com to start the conversation.

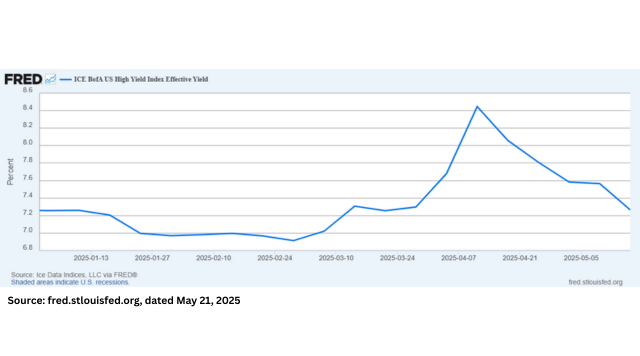

Markets have been showing some encouraging signs lately. Over the past couple of weeks, we've seen positive momentum building, and just last week, the S&P 500 moved above its 200-day moving average — a technical signal that often points to improving investor confidence. At the same time, market volatility has started to settle down, which is another reassuring sign.

We're also seeing credit risk ease, especially in the high-yield bond market, which has been calming down since early April. That tells us investors are becoming less fearful and more willing to take on risk. One area we'll need to keep watching closely is U.S. Treasury yields — if they continue to stabilize or drift lower, that would help confirm the improving outlook and support a healthier market backdrop.

Of course, some uncertainty remains — especially around the ongoing U.S.-China tariff talks. Until a final agreement is reached, we can expect some bumps along the way. But history tells us something important: times of extreme fear often turn out to be great buying opportunities for long-term investors.

If you've been sitting on the sidelines or are overdue for a portfolio check-up, this could be a smart time to consider rebalancing. There are still plenty of opportunities out there.

One thing to keep in mind — the risk of inflation hasn't gone away. Holding too much cash might feel safe now, but over time, inflation can quietly erode your purchasing power.

Visit my website https://lnkd.in/gWKHZ8Rd or email me at davidb.lee@td.com

Back in March, I shared some thoughts on US currency trends. This week, I'd like to revisit the topic—this time focusing on the dollar's relationship with Asian currencies.

Last week, the Taiwanese dollar strengthened notably against the U.S. dollar. This unexpected move raised questions: Is the U.S. becoming more tolerant of a weaker dollar in Asia?

There are reasons to think so. A softer dollar makes U.S. exports more competitive—especially in strategic sectors like semiconductors, electric vehicles, and clean tech.

But there may also be a strategic dimension. A stronger yuan would create added pressure on China, which has been trying to combat a deflationary environment. If the yuan appreciates further, it could worsen deflation—something China is working hard to avoid.

HongKong's dollar, which is pegged to the U.S. dollar, has also shown signs of strength, briefly dipping below its traditional support level. Alongside Taiwan's moves, this suggests a broader regional trend of appreciating currencies against the dollar.

How China responds will be key. Beijing is likely mindful of the 1985 Plaza Accord, which led to a sharp rise in the Japanese yen and contributed to Japan's "lost decades." That historical lesson is likely not forgotten.

In today's markets, exchange rates can carry more meaning than monetary policy alone—they can reflect power dynamics and strategic intent. This is one story that's worth watching closely.

Visit my website https://lnkd.in/gWKHZ8Rd or email me at davidb.lee@td.com

As another week in the markets comes to a close, I'd like to share a few thoughts along with a recent memo I found insightful. On Wednesday, the Bank of Canada announced that it would hold its overnight rate steady at 2.75%. While the decision may not have come as a surprise, it comes at a time when market volatility continues to weigh on investors' confidence.

In times like these, I often study trusted voices respected figures in our industry for their perspectives. One such voice is Howard Marks, Co-Chairman of Oaktree Capital Management, who recently published his third memo under the title "Nobody Knows." I found his latest letter, released on April 9th, particularly thought-provoking and wanted to share some key takeaways with you.

Marks emphasizes the importance of critical thinking, warning that constantly preparing for disaster can ironically lead to poor investment outcomes. He compares the current period of uncertainty to the volatility we experienced during the onset of COVID-19 in 2020 (and the financial crisis in 2008). Back then, as now, he chose to buy—but more importantly, he highlights that understanding why he bought matters far more than simply knowing that he did.

His core message is that trying to predict the future is futile. During the pandemic, many experts made confident forecasts, most of which were later proven wrong. Marks suggests that the future is inherently unknowable, and rather than guessing, investors should focus on responding thoughtfully to whatever the market brings.

He also makes a critical point: choosing not to act is still a form of decision, and one that carries its own risks. Inaction, driven by fear or uncertainty, must be assessed with just as much discipline as any active investment decision. I completely agree with this view.

I remember, just a few months ago, many investors regretted missing out on the rally in big tech stocks. But now that valuations have become more reasonable, emotions are once again getting in the way of rational action. If we think of the S&P 500 as a department store, many of the premium brands—large, high-quality companies—are currently on sale. Some leading tech companies are now trading at forward price-to-earnings ratios below 25.

Of course, no one knows when this "sale" will end. But if you take a measured approach—gradually investing over the next three to six months—this period could represent a valuable long-term opportunity.

I know that this is a challenging period for many investors, and market volatility may persist for some time. However, as the old saying goes, "market opportunities arrive in fear and grow in doubt." Rather than reacting to every market swing, I encourage you to stay focused on the long term investment objectives. I look forward to navigating the road ahead together - and rest assured, I'll continue to walk alongside you.

Visit my website https://lnkd.in/gWKHZ8Rd or email me at davidb.lee@td.com

This week, following President Trump's announcement on Wednesday 9th, regarding a 90-day pause on tariffs, we saw a dramatic reversal in the market, where the S&P climbed more than 10% in a single session. Even so, we're still seeing some technical volatility, as short sellers remain active and continue to test the strength of the rebound.

As I shared with our dear clients, there are two distinct types of risks in the market. The first is systematic risk—like what we experienced in 2008—an unexpected shock that takes most market participants by surprise. The second is sentiment-driven risk, which arises from investor emotions and changes in overall market confidence.

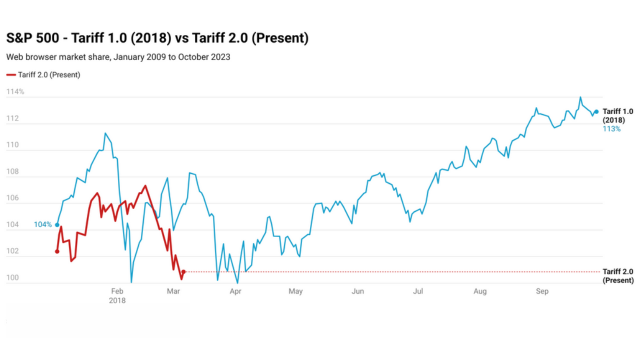

This recent bout of volatility is similar to what we experienced in 2018—more of a shake-up that, to some extent, is being driven by government-led policy shifts.

The U.S. government is aiming to lower debt burdens by fostering a lower interest rate environment, while also seeking to reduce the trade deficit with China and Europe.

Back in 2018, we also saw significant market volatility in Q1 and Q2, but we navigated through it successfully. There is still a possibility that the U.S. Federal Reserve, under Jerome Powell, may adjust interest rates in coming months in line with political pressure from the Trump administration. As such, I believe there's still room for optimism in Q3 and Q4.

While volatility may persist for the time being, for those investors who are currently rebalancing their portfolios or holding cash, this could present a good opportunity from a long-term perspective. We've seen how quickly sentiment and momentum can shift in response to positive developments, and it's in these moments that patient, disciplined investors are often rewarded. Rather than reacting to day-to-day market swings, staying focused on long-term goals and maintaining a disciplined approach remains key.

If you need investment advice or consultation, feel free to reach out anytime. I'm here to help you navigate these market conditions and make informed decisions for your portfolio.

Visit my website https://lnkd.in/gWKHZ8Rd or email me at davidb.lee@td.com

As of April 2nd, as expected by the market,reciprocal tariffshave been implemented by the U.S. I believe many retail investors may feel uncertain or face challenges in navigating the current market conditions. During times like these, strategic adjustments such as sector rebalancing and asset allocation diversification —including bonds—become even more important to mitigate volatility.

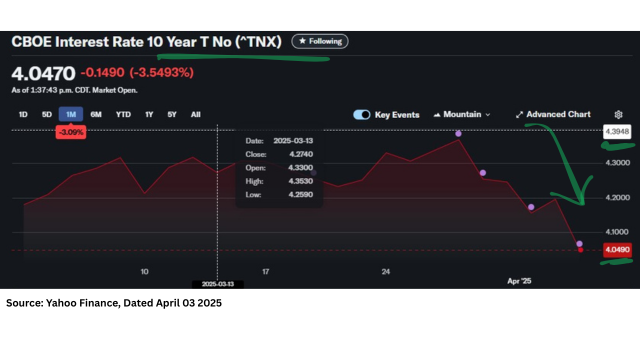

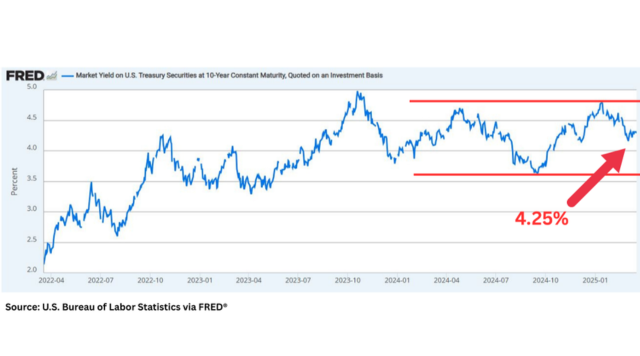

As I mentioned in my previous article on March 20th, it is important to monitor the current market environment in relation to movements in U.S. Treasury yields.

For the U.S., which carries a significant debt burden, maintaining a lower interest rate environment is crucial to reduce their substantial interest costs.

When market uncertainty increases, the treasury market tends to attract institutional money, leading to a rise in prices and a corresponding decline in yields.

As of today (April 03, 2025), the 10-year Treasury yield stands at around 4%, having declined more than 30 basis points from last month's peak, as shown in the chart below.

Market volatility is always part of the journey, and staying focused on your long-term financial goals through disciplined and well-calculated strategies is essential.

If you need investment advice or consultation, feel free to reach out anytime. I'm here to help you navigate these market conditions and make informed decisions for your portfolio.

Visit my websitehttps://lnkd.in/gWKHZ8Rdor email me atdavidb.lee@td.com

Hi everyone, today, I want to talk about AI infrastructure and how a major global investment is set to transform this critical sector.

Last Friday on March 21st, the United Arab Emirates (UAE) is making a historic investment in the U.S., pledging $1.4 trillion over the next decade. A substantial portion of this funding is directed toward AI infrastructure, alongside semiconductors and manufacturing, positioning the UAE as a key player in the future of global technology.

This commitment follows MGX, the UAE's tech investment arm, joining the $500 billion Stargate project—a collaboration between OpenAI, SoftBank, Oracle, and MGX to develop advanced AI datacenters in the U.S. The initiative aims to strengthen American AI competitiveness while generating 100,000 jobs.

AI infrastructure is the backbone of artificial intelligence, comprising data centers, high-performance computing (HPC), cloud computing, and advanced networking and storage systems. Without it, advancements in AI, machine learning, and automation would stall. However, one of the greatest challenges in scaling AI is power management. Large AI models require immense energy, making cost efficiency, sustainability, and system reliability top priorities.

By investing heavily in U.S. AI, the UAE is not just fueling economic growth but also securing its influence in global technology. This partnership reinforces the U.S.'s leadership in AI innovation, highlighting the geopolitical significance of technological dominance.

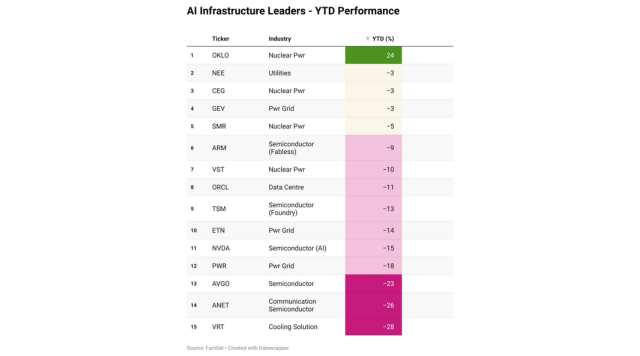

As AI infrastructure evolves, understanding its market dynamics and investment opportunities can provide a strategic edge. Below, I've summarized the year-to-date performance of AI infrastructure leaders.

In times like these, having a well-thought-out investment strategy and implementing it can be the edge that sets you apart.

Visit my website https://lnkd.in/gWKHZ8Rd or email me at davidb.lee@td.com

I encourage to everyone to pay close attention to this topic, as it offers important insight into the current market environment.

Today, I'd like to talk about the Triffin Dilemma, named after economist Robert Triffin, which highlights a fundamental paradox at the heart of the U.S. economy.

I believe understanding this concept helps explain the complex market conditions we're seeing today, as it captures the challenge of maintaining the U.S. dollar's global dominance while also managing the country's growing trade deficit.

This is critical to understand because it creates a contradictory situation: the U.S. needs a strong dollar to preserve its global supremacy, but at the same time, a weaker dollar is necessary to narrow the trade deficit - publicly, policymakers should call for a strong dollar, but behind the scenes, they are aiming for a weaker dollar and a low interest rate environment.

We need to recognize that a weaker dollar helps boost exports by making U.S. products cheaper overseas, while lower interest rates help ease the burden of the massive national debt and support the country's heavy defense spending.

One of the key takeaways from today's FOMC meeting was Powell's comment that inflation driven by tariffs under the Trump administration is considered "transitory", and this is worth noting.

Currently, the Federal Reserve is keeping interest rates unchanged, and U.S. 10-year Treasury yields are hovering around 4.25%.

Are you a high-net-worth investor or a commercial business owner needing to manage cash in holding companies?

Visit my website https://lnkd.in/gWKHZ8Rd or email me at davidb.lee@td.com

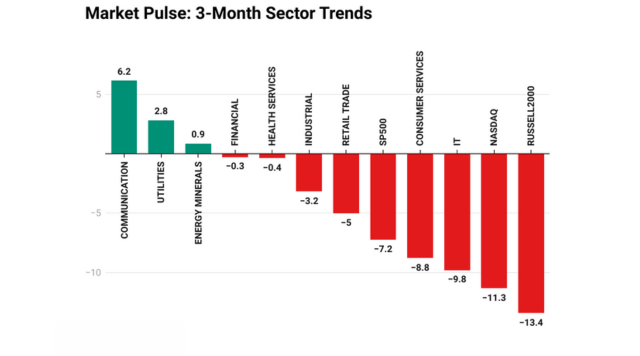

Today, major U.S. indices rebounded, but volatility is likely to continue until market uncertainties are resolved.

I know many individual Investors are facing a tough time right now, but please remember—investment opportunities often emerge through worry and uncertainty.

In times like these, having a well-thought-out investment strategy and implementing it can be the edge that sets you apart.

I’d like to work though this and navigate the road ahead together. I've summarized the trends of major sectors over the past three months to help guide decisions moving forward.

Contact me or email davidb.lee@td.com

With ongoing tariff negotiations and the resurgence of nationalism, inflation is likely to rise. This could create a challenging environment, with both Canada and the U.S. potentially facing increasing inflationary pressures. And also, potential deeper rate cuts by the Federal Reserve could further intensify inflation.

With inflation and potential currency depreciation, wealth held in cash is likely to lose purchasing power over the coming years. Relying solely on cash deposits (GICs) or fixed-income investments may not be a sustainable strategy. This makes having a well-structured investment plan more crucial than ever.

Now is the time for careful planning to protect your wealth and ensure your investments are working for you. Let's discuss how we can stay ahead of these challenges together.

The chart below compares the movement of the S&P500 in 2018 with its current trajectory. While past trends do not guarantee future performance, it serves as a reminder that US-China trade tension also played a role back in 2018.

Contact me or email at davidb.lee@td.com

The US stock market saw another decline today following the announcement of a 25% tariff on imports from Canada and Mexico. However, the market showed signs of recovery in the afternoon, with the declines narrowing.

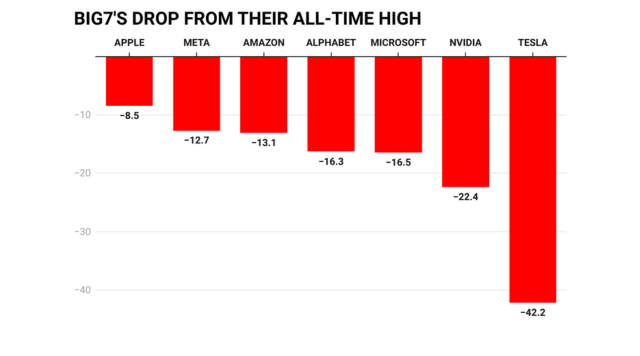

As I mentioned yesterday, big tech stocks have been notably affected, and I've summarized the the drop compared to their all-time-highs. Many quality stocks are now entering attractive price levels, potentially presenting a good opportunity.

This is a time that requires focus, and I'm here to help you navigate through it.

Let's work through this together.

Contact me or email davidb.lee@td.com

I believe some investors may be concerned about the market volatility surrounding tariffs these days. I often refer to situations like this as a 'contrarian opportunity,' and I think it would be good for us to discuss it together.

First, the big tech stocks (the Big Seven) are underperforming, and here's the chart for the Nasdaq, which has a significant portion of those stocks. If you look at the Fear-and-Greed chart, it shows a value of 24 as of today. A value below 25 is defined as extreme fear.

However, these kinds of situations don't happen often—this level of extreme fear has only occurred a few times in the past few years. While it's not always an accurate gauge, my thought is that during these short term corrections, or times of fear, dollar-cost-averaging through gradual buys could be a reasonable strategy.

Of course, this alone won't help you accurately pinpoint the bottom or the lowest point. I always say that when the news constantly fuels fear, individual investors often get scared and sell quality assets at lower prices. Long-term investing on your own is not as easy as it seems. In 2018, most individual investors faced considerable challenges.

But remember, there's no such thing as a truly new crisis. Once the market starts feeling fatigue from the same issue, it tends not to reflect that in prices, and the mood tends to shift.

I wanted to throw this topic out there for us to discuss. Let's think about it together.

Contact me or email davidb.lee@td.com

Will the US Create a Sovereign Wealth Fund?

The United States, a global economic powerhouse, is reportedly considering a move that could significantly reshape its financial landscape: the creation of a sovereign wealth fund (SWF). This prospect has ignited discussions among economists and investors, raising questions about its potential impact on the US economy and global markets.

A sovereign wealth fund is a state-owned investment fund typically financed by government surpluses, foreign exchange reserves, or revenues from natural resources. These funds are strategically deployed to invest in a diverse range of assets, including stocks, bonds, real estate, and infrastructure projects, with the aim of generating long-term returns for the nation.

Several factors are driving the US's potential interest in establishing a SWF. It could serve as a mechanism for saving for future generations, ensuring long-term financial security. Additionally, a SWF could facilitate strategic investments in critical sectors and infrastructure projects, boosting economic growth and competitiveness. Another potential advantage is its role in managing the national debt, which could help reduce its burden over time.

The concept of a US sovereign wealth fund has sparked debate, with compelling arguments on both sides. Proponents argue that a SWF can accumulate wealth for future generations, addressing long-term societal needs and reducing reliance on short-term economic cycles. It could also fund crucial infrastructure projects, research and development, and emerging technologies, fostering innovation and economic growth. Furthermore, returns generated by the SWF could be used to alleviate the national debt burden, improving the nation's fiscal health. A large US SWF could also enhance the nation's financial influence on the global stage.

However, critics raise concerns about fiscal responsibility, arguing that establishing a SWF could divert funds from essential government programs and potentially lead to irresponsible spending. Others worry that a SWF would grant the government excessive control over the economy, potentially stifling private sector innovation and investment. Managing such a large and complex fund would also require expertise and transparency, raising concerns about potential mismanagement, corruption, and political interference.

The possibility of the US establishing a sovereign wealth fund is a complex issue with far-reaching consequences. While the potential benefits, such as long-term savings, strategic investments, and debt management, are appealing, the potential drawbacks, including fiscal responsibility concerns and management challenges, cannot be ignored. A thorough and transparent debate is crucial to determine whether a US SWF is a prudent and beneficial step for the nation's economic future. The decision will undoubtedly have a significant impact on both the US and global economies for years to come.

Sam Altman, a leading voice in artificial intelligence (AI), has shared predictions about how AI will shape the future. His insights highlight rapid advancements, societal transformations, and investment opportunities, suggesting significant shifts in technological and economic landscapes.

Altman suggests that AI is evolving at a rate faster than Moore's Law, which traditionally states that computing power doubles every 18 months. He believes AI intelligence could double every year, potentially leading to increased efficiency, reduced costs, and accelerated economic growth. This rapid development may influence various industries, driving technological progress at an unprecedented pace.

AI advancements are expected to have substantial societal impacts. In healthcare, AI may contribute to more effective disease treatment and improved accessibility to medical solutions. Additionally, AI-driven automation could alter how individuals allocate their time, potentially affecting work-life balance and productivity. These transformations raise questions about how society will adapt to increased reliance on AI-driven systems. Altman has also speculated about the potential for AI to democratize access to influence and success. He suggests that as AI tools become more advanced and widely available, individuals may gain capabilities that were previously limited to a select few, potentially changing traditional power dynamics within industries and society.

The speed of AI innovation is described as accelerating rapidly, with improvements in performance and cost reduction contributing to continuous technological progress. This trend may lead to ongoing advancements across multiple fields, prompting discussions about regulation, ethical considerations, and long-term implications.

Regarding investment opportunities, Altman, along with other experts such as Cathie Wood, has identified sectors that may benefit from AI's growth. These include autonomous driving, where AI-powered systems are improving self-driving technology; drug development, where AI is playing a role in discovering new treatments; and AI software companies, which are leveraging artificial intelligence to enhance data analysis and decision-making processes.

Altman's perspective reflects the broader discussions surrounding AI's trajectory, including both its potential benefits and challenges. As AI continues to develop, its influence on industries, economies, and daily life remains a key area of observation and analysis.

David B. Lee, CFP®, CIM®

Investment Advisor

TD Wealth Private Investment Advice

Email: davidb.lee@td.com

*This article is for informational purposes only and should not be considered investment advice or a solicitation to buy or sell any securities. All investment decisions should be made based on your own research and consultation with a qualified financial professional.

Big Tech's Nuclear Ambitions: The Rise of Small Modular Reactors

The energy demands of the modern digital world are staggering. Massive data centers, the backbone of cloud computing and online services, consume vast amounts of electricity. As tech giants like Google, Amazon, and Microsoft strive for carbon neutrality and reliable power, they're increasingly looking towards a new generation of nuclear technology: Small Modular Reactors (SMRs).

SMRs represent a significant departure from traditional, large-scale nuclear power plants. Their smaller size allows for factory fabrication and modular construction, potentially leading to faster deployment and reduced capital costs. This modularity also offers greater flexibility in siting, making them suitable for locations where larger plants might be impractical. Furthermore, proponents argue that SMRs incorporate advanced safety features, reducing the risk of accidents.

This potential has caught the attention of big tech. For companies committed to sustainability and needing a consistent, carbon-free power supply for their energy-hungry data centers, SMRs offer a compelling alternative to fossil fuels and intermittent renewable sources. The promise of reliable baseload power, independent of weather conditions, is particularly attractive.

Several companies are leading the charge in SMR development. NuScale Power, for instance, has gained significant traction with its light water reactor design. Oklo is pursuing fast reactor technology, which offers the potential for even greater efficiency and waste reduction. Constellation Energy, a major player in the nuclear power sector, is also exploring the potential of SMRs.

However, the path to widespread SMR adoption is not without its hurdles. The technology is still relatively nascent, and significant challenges remain. High upfront costs, complex regulatory processes, and the need for further research and development are all obstacles that must be overcome. The long-term economic viability of SMRs is also yet to be fully demonstrated.

Despite these challenges, the growing interest from tech giants signals a potential shift in the energy landscape. While SMRs are not a silver bullet solution to our energy needs, they could play a crucial role in a diversified, low-carbon future. The convergence of technological innovation, increasing energy demands, and the urgent need to address climate change has created a unique opportunity for SMRs to prove their worth. Whether they can live up to the hype remains to be seen, but the coming years will be crucial in determining the role of SMRs in powering the digital age.

David B. Lee, CFP®, CIM®

TD Wealth Private Investment Advice

Investment Advisor

Direct: (250) 470-3045

https://lnkd.in/gWKHZ8Rd