CMB Wealth Management

CMB Wealth Management

Our fully customized wealth solutions are developed through a comprehensive process rooted in an in-depth understanding of your evolving needs and directed by our years of diversified experience helping high-net-worth families, professionals, active business owners, retirees and institutions grow, protect and transition wealth.

By integrating the various aspects of your financial life into a single, achievable strategy, we aim to simplify your current situation as we take the steps necessary to help you realize your future objectives.

Our Services

Investment Planning

Transfer of Wealth

Will and Estate Planning

Retirement Planning

Achieve what truly matters to you

Tailored Solutions

Your unique goals

You've worked hard to get where you are today. Now's the time to maintain, grow, and protect your net worth. Get tailored advice, solutions, and strategies that can help achieve your goals.

Research and Insights From The Wealth Investment Office

Staying on top of financial markets is important for making investment decisions. Check out our latest commentary and analysis.

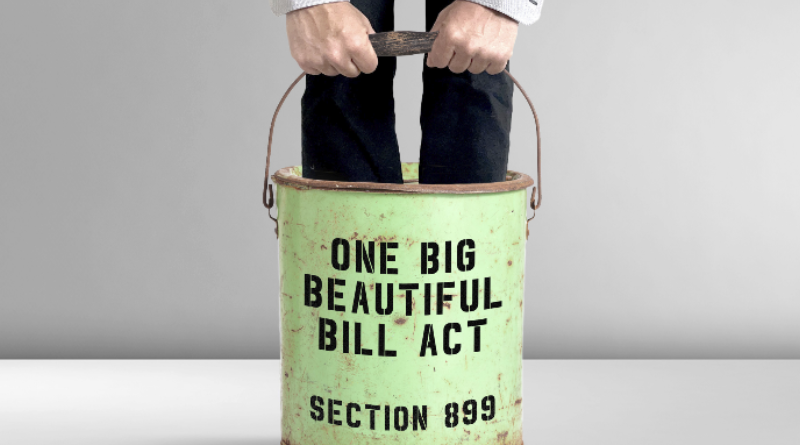

Monthly Perspectives: June 2025 | Standing in a Bucket

The One Big Beautiful Bill Act is a big piece of legislation, and it includes many proposed tax measures in the U.S. that impact non-citizens and non-residents. This includes a new Section 899, increasing federal income tax and withholding tax rates on U.S.-sourced income earned by Canadian corporations and individuals. Let’s expect the best but plan for the worst. At the end of the day, the best way to manage risk is to ensure you have the right plan in place and stay diversified. Read on.

Monthly Perspectives: Monthly Perspectives: March 2025 | A Bigger Boat

Relentless suspense. The fear of the unknown. The shark attacks themselves. As the tension increased, so did the stakes. They're on the fishing vessel, and suddenly, this massive great white surfaces, leading Chief Brody to inform the shark hunter with the now famous line: “You’re gonna need a bigger boat.” That’s the idea that inspired this month’s Perspectives. The best way to safely and profitably navigate the ocean while protecting against predators is a well-managed, diversified portfolio.

WIO: Portfolio Strategy Quarterly | Q2 2025

“When you blow at high dough” is a call to avoid acting impulsively when you have a lot at stake. In today’s environment of tariffs, tweets, and contradictions, it’s easy to lose focus. But in times like these, investors must evolve at the speed of thought. Read on.

Trending Articles

Stay informed and enhance your investment knowledge with our curated articles on the latest news, strategies and insights.

Estate planning basics

Article

Estate planning basics

An estate plan can help ensure your wishes are fulfilled if you become incapacitated and when you pass away. Here’s what you should know about building one.

Mark Carney leads Liberals to victory: Now what?

Article

Mark Carney leads Liberals to victory: Now what?

Mark Carney and his Liberal Party have won a fourth term in Canada’s federal election. The new Carney-led government will take the helm amid ongoing political and economic uncertainty. MoneyTalks’ Kim Parlee speaks with Frank McKenna, Deputy Chair, Wholesale Banking at TD Bank Group and Beata Caranci, Chief Economist with TD, about the election results, relations with the U.S., and the road ahead for Canada’s economy.

Buying a home on your own: Ideas for a challenging market

Article

Buying a home on your own: Ideas for a challenging market

Despite ongoing affordability issues, almost half of first-time homebuyers say they want to apply for a mortgage on their own. If you're one of them, here are a few ideas to help you get started.