Brock Bieber

Phone

Office Location

At Bieber Wealth Advisory, we take the time to get to know you, your family and your business so we can help empower you to make smart, informed decisions about your financial future.

With a focus of serving affluent business owners, professionals, and agricultural families our mission is simple: to provide our clients with confidence and clarity at every stage of life.

Bieber Wealth Advisory is part of TD Wealth Private Investment Advice, a division of TD Waterhouse Canada Inc. which is a subsidiary of The Toronto-Dominion Bank.

Certificates

CIM®

CFP®

FCSI®

Education

B.Comm (Hons.) - Asper School of Business, University of Manitoba

Navigating your wealth journey with confidence

Our Holistic Approach

Working together every step of the way

Running a business and planning for the future can seem daunting, but it doesn't have to be. We will:

- Work with you to understand your priorities.

- Create a wealth plan that considers your financial picture.

- Schedule regular check-ins to track progress.

- Work with other TD specialists including, TD Small Business Banking and TD Commercial Banking, to help support your needs.

- Offer ongoing support to help you move forward confidently.

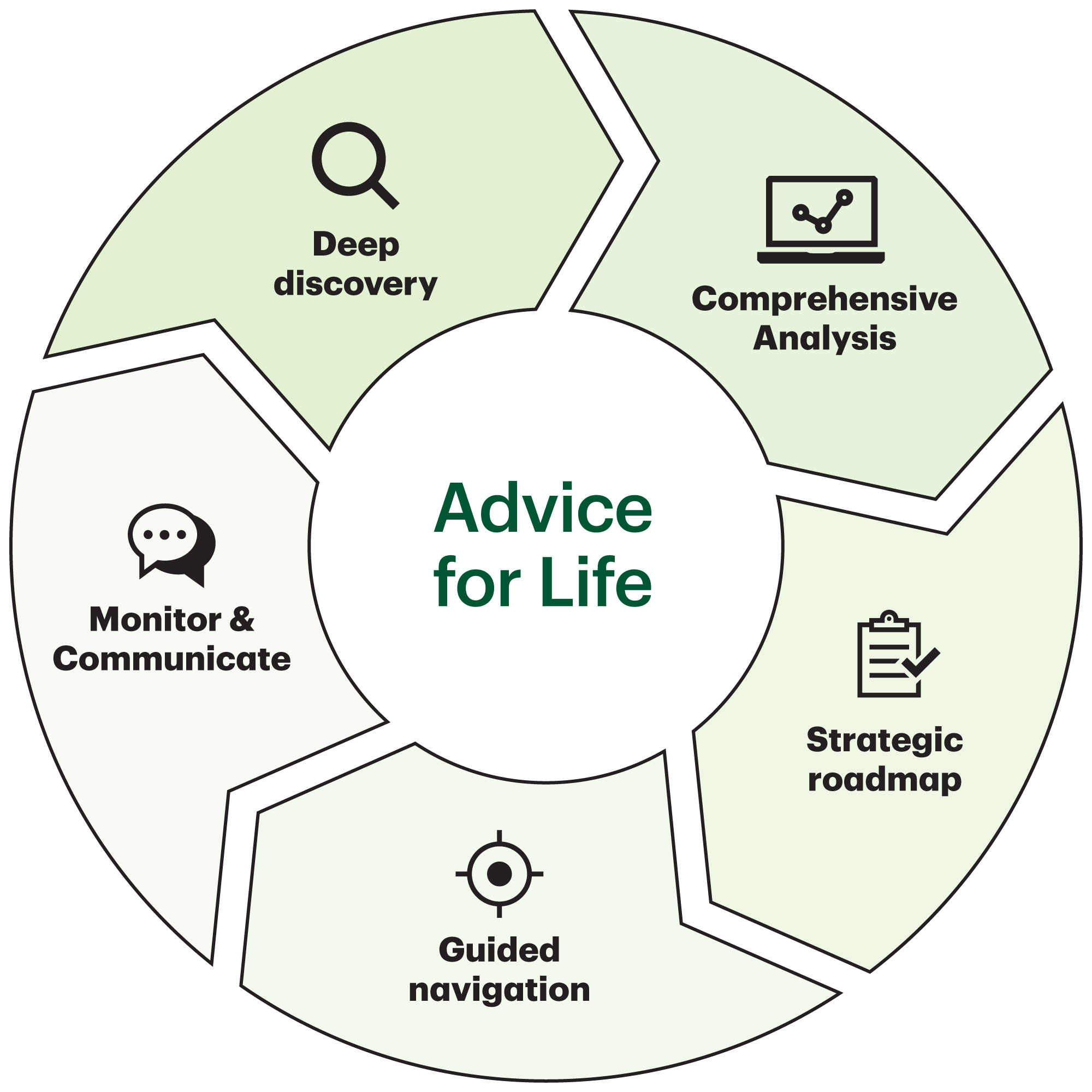

Advice for Life

Understanding you

We start with a deep understanding of who you are, your values and your vision of

success. This means reviewing the financial decisions you’ve made over the years, the

goals you’ve set for yourself in the years to come, and the ways in which these reflect

what is important in your life. To create your personal investment and wealth plan, we

leverage our broad expertise to fit your unique needs.

Business Owners

We know that business owners have specific wealth management priorities. We bring in other TD specialists as needed to identify tax-effective strategies for your key accounts, leverage insurance structures to maximize estate value, and plan the transfer or sale of your business.

High Net-Worth Individuals and Families

We recognize that every family has unique needs. We use our knowledge and experience to design a wealth management strategy to help meet those needs. Involving other TD specialists early in the process lets us simultaneously create professionally managed portfolios and wealth management plans to quickly identify and address priorities.

Professionals

Professionals such as physicians, dentists, accountants, lawyers and notaries are highly focused on their work and do not always have time to manage their investments and assets on a daily basis. Delegating day-to-day and discretionary portfolio management to our team adds value and saves our clients time.

Jessica - Seeing new possibilities with the right financial advice

When it comes to investing for your future, it can be difficult to find the right balance when prioritizing multiple goals. Finding the right advisor can be a critical step toward building a personalized plan that could help you reach your financial goals.

For Jessica, she wanted to experience life and make memories with her family. Financial advice from TD Wealth allowed her to see new possibilities, so she can enjoy today AND save for her future.

Connect with me to learn how you can prioritize what is important, while focusing on your financial goals.

Our Services

wealth management strategies with client-focused service. With the collaboration of TD specialists we can help you with:

- Investment management

- Retirement planning

- Cash-flow management

- Strategic tax planning

- Asset protection

- Education-savings support

- Charitable giving and philanthropy

- Business succession support

- Private banking

- Custom credit services

- Insurance advice

- Wealth transfer

- Trust and wills