Making an impact with our ESG Dividend Growth Portfolio

As we remain committed to meeting the unique needs of our clients, we've introduced responsible investment options to better align our strategies with what matters most to you.

By incorporating Environmental, Social and Governance (ESG) factors into the decision-making process, Responsible Investing can help generate sustainable, long-term returns while managing risk.

This model resonates with clients who are not only looking to achieve short- and long-term financial goals but are particularly interested in aligning their investments with their own personal values. If you are focused on effecting a positive societal impact, Responsible Investing may be a viable approach.

By incorporating Environmental, Social and Governance (ESG) factors into the decision-making process, Responsible Investing can help generate sustainable, long-term returns while managing risk.

This model resonates with clients who are not only looking to achieve short- and long-term financial goals but are particularly interested in aligning their investments with their own personal values. If you are focused on effecting a positive societal impact, Responsible Investing may be a viable approach.

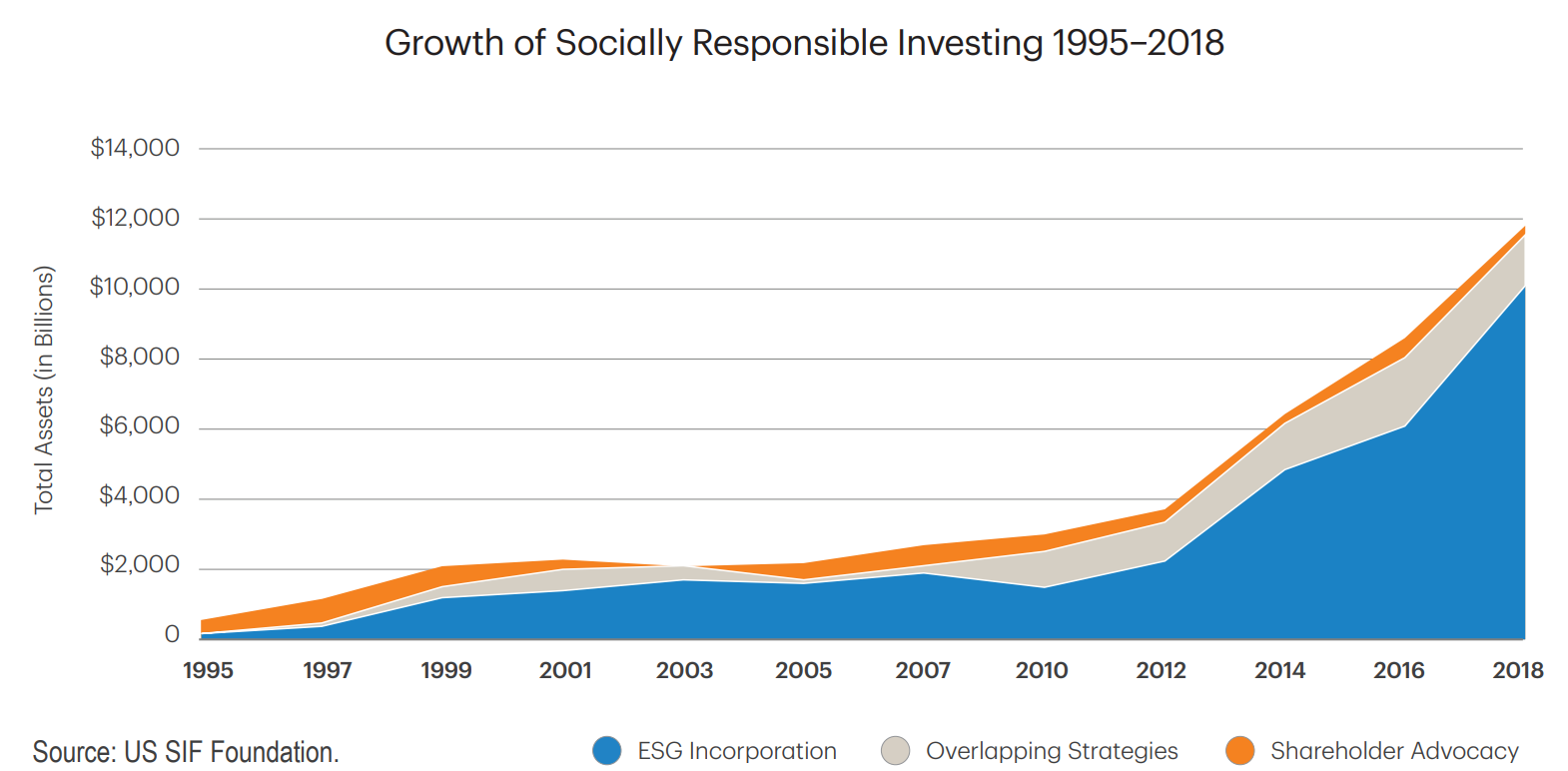

Responsible Investing is on the rise

Whether it be attributable to increasing environmental concerns, societal pressures, or specific governance policies, demand for ESG products are certainly on the rise. At LSBB Family Office, we take pride in being at the forefront of this important change.

Reinforcing our commitment to responsible investing, we now offer an ESG Dividend Growth Portfolio. This portfolio leverages the quantitative insights of Morningstar CPMS research, as well as Sustainalytics' decades of experience with ESG investing.

At its core, our portfolio is tilted towards investments in businesses that remain committed to effecting positive change around the globe.

What does Responsible Investing really mean? Responsible Investing is an investment approach that looks to drive global impact and do so without compromising the opportunity to gain a competitive financial return.

Reinforcing our commitment to responsible investing, we now offer an ESG Dividend Growth Portfolio. This portfolio leverages the quantitative insights of Morningstar CPMS research, as well as Sustainalytics' decades of experience with ESG investing.

At its core, our portfolio is tilted towards investments in businesses that remain committed to effecting positive change around the globe.

What does Responsible Investing really mean? Responsible Investing is an investment approach that looks to drive global impact and do so without compromising the opportunity to gain a competitive financial return.

Our ESG Dividend Growth Portfolio

Maintains a defined focus on:

- Companies that are industry leaders

- Maximum positive impact on SDGs

- High-quality compounders

- Underestimated Free Cash Flow (FCF) production

Leverages a scalable and repeatable process that incorporates:

- Qualitative & quantitative data

- Morningstar CPMS Fundamental research

- Sustainalytics (ESG) research

How do we measure impact?

The United Nations Sustainable Development Goals (UN SDG) help us understand and measure investors' real-world impact through their investment decisions. We leverage these goals as an important framework in our own portfolio development process.

Performance does not need to be compromised when taking a responsible investing approach. Research is beginning to show that companies maintaining ESG focused policies tend to outperform companies that do not score well.

Responsible Investing can help minimize the long-term risks associated with your investments. While traditional risk management tools focus almost exclusively on financial metrics, Responsible Investing contributes to risk mitigation by analyzing a company's business model and assessing it through a long-term, sustainable-lens. Companies that are focused on positive long-term growth are those that may demonstrate a lower risk level. Our objective is to avoid companies that engage in potentially harmful business practices or maintain controversial policies that may contribute negatively to their long-term value.

SRI asset size reflects a rapidly growing market: Sustainable, Responsible, Impact investing (SRI) assets have expanded to $12.0 trillion in the United States, up 38 percent from $8.7 trillion in 2016, according to the US SIF Foundation.

Responsible Investing can help minimize the long-term risks associated with your investments. While traditional risk management tools focus almost exclusively on financial metrics, Responsible Investing contributes to risk mitigation by analyzing a company's business model and assessing it through a long-term, sustainable-lens. Companies that are focused on positive long-term growth are those that may demonstrate a lower risk level. Our objective is to avoid companies that engage in potentially harmful business practices or maintain controversial policies that may contribute negatively to their long-term value.

SRI asset size reflects a rapidly growing market: Sustainable, Responsible, Impact investing (SRI) assets have expanded to $12.0 trillion in the United States, up 38 percent from $8.7 trillion in 2016, according to the US SIF Foundation.