Hello everyone,

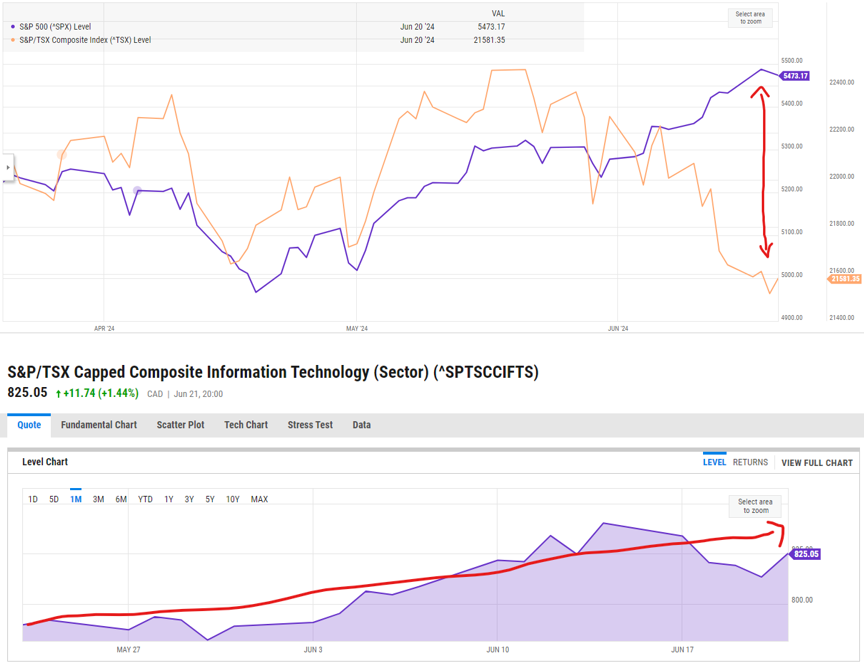

Happy June! Or, shall I say, not so Happy June? LOL. The TSX is off 3% from May's close and the S&P 500 is up again, 4% (Source: www.ycharts.com, June 20, 2024), at the time of this writing! The tale of two Indexes, a story worth examining, I think.

Technology stocks in the U.S. have also been soaring, propelled by AI rocket fuel. Nvidia continues to set record highs and Dell just announced it's building an AI factory with Nvidia to help Mr. Jetson's (Elon Musk) xAI Grok supercomputer (whole other topic) development.

Q1 earnings in the U.S. have been posting results that have generally been positive and supportive of stocks. The expectation of a 7.1% year-over-year increase in Q1 earnings surpasses the pre-earning season estimate of 3.8%. Additionally, over 80% (Bloomberg Intelligence) of reporting S&P 500 companies have beaten Q1 earnings estimates, which suggests strong performance across a significant portion of the market.

These positive Q1 earnings results have contributed to investor confidence and has led to increased stock prices, of which we have seen. When companies report higher-than-expected earnings, it often reflects positively on their financial health and growth prospects, which can attract investors and drive stock price appreciation.

The said above essentially marks how the two indexes are diverging but similarly, and the economies in Canada and the U.S. are doing the same thing from a monetary policy standpoint. The divergence in monetary policy between the Bank of Canada and the U.S. Federal Reserve could potentially lead to volatility for the Canadian dollar in the future. If the Bank of Canada's interest rates fall too much below those of the Fed, it could negatively impact the Canadian dollar. This would result in more expensive imports from the U.S. and put upward pressure on inflation. Moreover, experts suggest that if the Bank of Canada continues to cut rates while the Fed remains unchanged, significant divergence could occur even further.

The U.S. economy has shown resilience in the face of higher borrowing costs and inflation, and the Federal Reserve has indicated the need for more positive data to confirm sustainable inflation decline. In contrast, the Bank of Canada recently announced its first interest rate cut in over four years following a period of hiking rates to control inflation. Governor Tiff Macklem expressed confidence that inflation is heading towards the target of two percent.

The differences in interest rate sensitivity between the two countries are attributed to factors such as the length of mortgage terms and the dependence of the Canadian market on commodities like oil. The Canadian dollar could find support in rising energy prices if they continue to increase.

Historically, a difference of one percentage point in overnight rates between Canada and the U.S. has been considered a comfortable zone. While some experts believe there is room for divergence between the two central banks, the extent is uncertain. The market currently indicates a possibility of one rate cut by the Federal Reserve in September and another in December. Seems to be getting less and less every time I write an editorial! Lol.

Investors hoping for lower rates received some optimism with the easing of consumer price inflation in May. The Bank of Canada will evaluate interest rate decisions on a meeting-by-meeting basis and may consider further cuts if inflation eases and confidence in reaching the two percent target zone.

So, you may ask, what's in store besides the said above? In the month of July, stock markets have historically demonstrated varied performance, with some years experiencing notable gains while others may see more modest results. For instance, recent reports indicate that the stock market has exhibited strong performance in the month of July, with the S&P 500 index rising 3.3% on average between 2012 and 2022 (www.marketwatch.com/story/july-can-be-a-top-month-for-stocks-heres-what-it-will-take-for-the-market-to-rally-again-this-summer-9b3c3ef5).

Furthermore, in 2022, the S&P 500 rose by 9.1% in July, marking its best performance since November 2020 (www.nytimes.com/2022/07/29/business/stock-market-july.html).

Moreover, experts have pointed to factors such as positive earnings results and market optimism as potential drivers for stock market rallies in July (abcnews.go.com/Business). Additionally, predictions from market strategists suggest expectations for continued strong performance in July. But here's some food for thought: the market has surged approximately 50% since October 2022, surpassing the advancements of its predecessors dating back to 1957 and the latest Bloomberg market live pulse survey indicates that investors are becoming more apprehensive about the rich valuations in the stock markets. Not surprising considering the U.S. benchmark has hit many record closing highs this year. The stock markets are hot!

And so, in keeping with that theme, I'm hoping it will stay that way! But if it doesn’t, you know what else July will bring? Cold cocktails, relaxation and great company! So keep calm and SUMMER on! LOL…

The information contained herein has been provided by Rietze Duke & Associates Wealth Management and is for information purposes only. The information has been drawn from sources believed to be reliable. Graphs and charts are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual's objectives and risk tolerance.

Commissions, management fees and expenses all may be associated with investments in exchange-traded funds (ETFs). Please read the prospectus and ETF Facts before investing. ETFs are not guaranteed, their values change frequently and past performance may not be repeated. ETF units are bought and sold at market price on a stock exchange and brokerage commissions will reduce returns.

Certain statements in this document may contain forward-looking statements (“FLS”) that are predictive in nature and may include words such as “expects”, “anticipates”, “intends”, “believes”, “estimates” and similar forward-looking expressions or negative versions thereof. FLS are based on current expectations and projections about future general economic, political, and relevant market factors, such as interest and foreign exchange rates, equity and capital markets, the general business environment, assuming no changes to tax or other laws or government regulation or catastrophic events. Expectations and projections about future events are inherently subject to risks and uncertainties, which may be unforeseeable. Such expectations and projections may be incorrect in the future. FLS are not guarantees of future performance. Actual events could differ materially from those expressed or implied in any FLS. A number of important factors including those factors set out above can contribute to these digressions. You should avoid placing any reliance on FLS.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2026. FTSE Russell is a trading name of certain of the LSE Group companies. “FTSE®”, “Russell®”, and “FTSE Russell®” are trademarks of the relevant LSE Group companies and are used by any other LSE Group company under license. “TMX®” is a trademark of TSX, Inc. and used by the LSE Group under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. Index returns are shown for comparative purposes only.

Indexes are unmanaged and their returns include reinvestment of dividends, if applicable, but do not include any sales charges or fees as such costs would lower performance. It is not possible to invest directly in an index.

Links to other websites are for convenience only. No endorsement of any third-party products, services or information is expressed or implied by any information, material or content referred to or included on or linked from or to here.

TD Asset Management Inc. is a wholly-owned subsidiary of The Toronto-Dominion Bank.

Rietze Duke & Associates Wealth Management is part of TD Wealth Private Investment Advice, a division of TD Waterhouse Canada Inc. which is a subsidiary of The Toronto-Dominion Bank.

®The TD logo and other TD trademarks are the property of The Toronto-Dominion Bank or its subsidiaries.