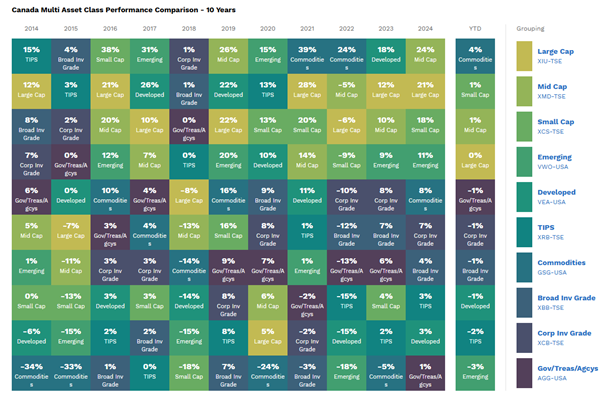

I was doing some research the other day and stumbled across this chart. I had seen others like it, as year-end is a good time to post something like this. It’s a great snapshot of the last 10 years. It got me thinking and relating it back to what we do when we manage people’s money and how we work on diversification to help clients achieve their financial goals. This inspired me to write about the importance of diversification and some takeaways from this simple graphic.

[1] Source: FactSet, Data as of Jan 16, 2025.

The Case for Diversification: Lessons from 10 Years of Asset Class Performance

When it comes to investing, one of the most valuable principles to embrace is diversification. This concept involves spreading your investments across different asset classes to help manage risk and optimize returns. The graphic above, which illustrates the performance of various Canadian and global asset classes over the past decade, is a striking visual reminder of why diversification is so important.

[1] Source: FactSet, Data as of Jan 16, 2025.

The Case for Diversification: Lessons from 10 Years of Asset Class Performance

When it comes to investing, one of the most valuable principles to embrace is diversification. This concept involves spreading your investments across different asset classes to help manage risk and optimize returns. The graphic above, which illustrates the performance of various Canadian and global asset classes over the past decade, is a striking visual reminder of why diversification is so important.

Key Takeaways from the Graphic

No Single Winner: If you look closely at the chart, you’ll notice that no asset class consistently outperforms every year. For instance, Small Cap equities topped the charts in 2016 and 2023 but lagged in other years. Similarly, Commodities had an outstanding 2021 but were among the worst performers in 2014 and 2015. You can constantly follow along to see that most asset classes jump around on the chart year over year.

The Importance of Balance: Asset classes like TIPS (Treasury Inflation-Protected Securities) and Broad Investment Grade bonds often provided stability during turbulent times, such as 2022 when equities struggled. These assets may not deliver the highest returns, but they play a crucial role in offsetting volatility.

Cyclicality Is Key: Markets are inherently cyclical, and leadership among asset classes shifts frequently. For example, Large Cap equities had strong years in 2014 and 2021 but underperformed in 2018 and 2023. This unpredictability underscores why relying on a single asset class can be risky.

Emerging Markets and Developed Equities: These categories illustrate the variability of global markets. Emerging markets performed well in 2017 but faced challenges in subsequent years. Meanwhile, developed equities often found a middle ground, delivering steady, if unspectacular, returns.

The Role of Diversification in Your Portfolio

Diversification ensures that you don’t have all your eggs in one basket. By including a mix of asset classes like equities, bonds, commodities, and more, you can:

Reduce Risk: Different assets often respond differently to economic and market conditions. When equities decline, bonds or TIPS might hold steady or even increase in value.

Enhance Returns: While diversification doesn’t guarantee profits, it can smooth out the ride and help you capture gains across different market cycles.

Provide Stability: A diversified portfolio can act as a buffer during periods of market volatility, helping you stay on track with your long-term financial goals.

How We Put This into Practice at Pinnacle Family Wealth Advisory Group

At Pinnacle Family Wealth Advisory Group, we live and breathe the principles of diversification. Our team works closely with each client to craft personalized investment strategies that balance growth and protection. We firmly believe that diversification is a key aspect of most people’s wealth plans and that employing a strategy that effectively utilizes diversification helps clients meet their goals.

We believe that true diversification goes beyond just numbers and charts. It’s about understanding your unique goals, risk tolerance, and time horizon. Whether you’re planning for retirement, funding a child’s education, or building a legacy, our team is here to guide you every step of the way.

Closing Thoughts

The decade of data in the chart is a vivid reminder that markets are dynamic and unpredictable. However, with the right advice and strategy in place, you can make your financial journey as smooth as possible while working towards achieving your goals. At Pinnacle Family Wealth Advisory Group, we’re proud to help our clients achieve this balance.

As mentioned, if you are working with Pinnacle Family Wealth Advisory Group then we are already implementing these principles. If you aren't working with us and you're ready to take the next step in your financial journey, let's start the conversation today.