Newsletters

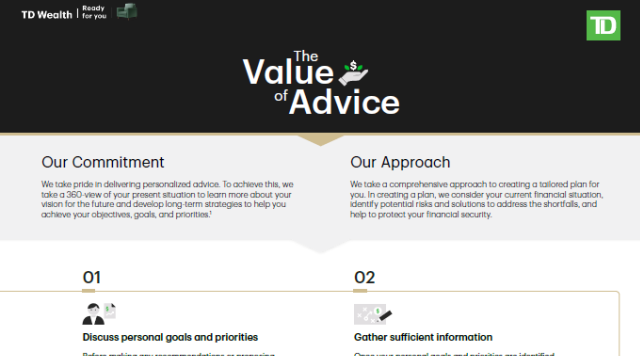

We take pride in delivering personalized advice. To achieve this, we take a 360-view of your present situation to learn more about your vision for the future and develop long-term strategies to help you achieve your objectives, goals, and priorities.

Leaving a lasting legacy for your family can involve careful planning and a team of professionals. Here are five questions that can help get you started.

Stepfamilies are common, but planning for who gets what after you die is anything but routine. When families come together, each with their own possessions, ensuring your assets go where you want is key.

Following two difficult years, the need for giving continues to grow, in Canada and across the world. For those who would like to make philanthropy a part of their legacy, here are seven key considerations (and surprising tax benefits) you should be aware of.

Many people know at least a little about RRSPs. But what about RRIFs? If you’re in or nearing retirement, are you ready to begin the big conversion? Here’s a quick guide to the world of RRIFs.

Financial scams and fraud come in many different forms. Sometimes they arrive in the form of a text message, email, or phone call, and often these forms for fraudulent communications are designed to look like they are coming from your bank.