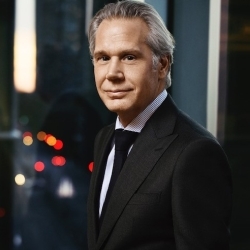

Louis-Philippe Barrette

Phone

Office Location

I believe that the only certain thing is uncertainty. I head up a team of financial professionals with experience in several segments of the financial services industry. Together, we work on preparing for the unexpected and coaching our clients through financial decisions.

Although investment management is at the core of what we do, our offering goes well beyond it. We achieve this by working closely with a team of TD specialists to help simplify several matters for our clients, such as:

· Transitioning a business;

· Minimizing taxes;

· Passing on wealth;

· And ensuring that family members are properly taken care of.

Applying singular approaches, we assist you in achieving an integrated financial structure and provide you with investment solutions that are consistent with your intricate situation and the financial market outlook.

Phone

Fax

(514) 289-0032

Languages

English

French

Investment Methodology

Our approach to building investment portfolios is based on the following core convictions:

- We invest in our highest persuasion ideas for each asset class;

- We are committed to long term valuable companies at attractive prices;

- We believe that alternative investments should be a part of every portfolio.

We develop strategies based on your vision for the future

Your values and goals are unique to you. When it comes to investing not everything that counts can be counted.

ESG principles are essentially a more comprehensive way to look at a company or investment, beyond just profit or loss numbers on a balance sheet. When it comes to investing not everything that counts can be counted. Encompassing non-financial information, ESG factors give you a richer view of a company's risks and growth prospects.

If sustainability is important to you, we have designed a strategy to provide strong risk adjusted returns by investing in companies with favourable environmental, social and governance characteristics.

Investing responsibly doesn’t have to come at the expense of performance.

ESG principles are essentially a more comprehensive way to look at a company or investment, beyond just profit or loss numbers on a balance sheet. When it comes to investing not everything that counts can be counted. Encompassing non-financial information, ESG factors give you a richer view of a company's risks and growth prospects.

If sustainability is important to you, we have designed a strategy to provide strong risk adjusted returns by investing in companies with favourable environmental, social and governance characteristics.

Investing responsibly doesn’t have to come at the expense of performance.

Alternative solutions

Over the past decade, the financial environment has created a challenging landscape for investors. Many of the investment strategies that have worked so well for the past thirty years are less likely to be effective going forward.

The key risk is that portfolio returns result in a shortfall. Fixed income products, equity markets have become increasingly volatile, and global financial issues are numerous and highly interconnected. In this new environment, traditional 60/40 portfolios and traditional market benchmark indices are becoming less and less relevant as most investors’ objectives involve absolute return requirements, while ignoring relative performance.

It is important to recognize that, while traditional asset-class diversification strategies may help investors reduce volatility in normal market conditions; they generally struggle during extreme events, when asset-class correlations increase. These correlations increase due in large part to the fact that inside every asset class and security are multiple shared risk factors, which can be thought of as the DNA of a portfolio.

The key risk is that portfolio returns result in a shortfall. Fixed income products, equity markets have become increasingly volatile, and global financial issues are numerous and highly interconnected. In this new environment, traditional 60/40 portfolios and traditional market benchmark indices are becoming less and less relevant as most investors’ objectives involve absolute return requirements, while ignoring relative performance.

It is important to recognize that, while traditional asset-class diversification strategies may help investors reduce volatility in normal market conditions; they generally struggle during extreme events, when asset-class correlations increase. These correlations increase due in large part to the fact that inside every asset class and security are multiple shared risk factors, which can be thought of as the DNA of a portfolio.

Our Services

Your goals are our priority so when you work with us, you have access to experienced professionals across all our products and services. Whether you need answers about wealth strategies, retirement planning or transfer of wealth, we're here to help.

Tabs Menu: to navigate this menu, press tab and use the left & right arrow keys to change tabs. Press tab to go into the content. Shift-tab to return to the tabs.

Investment Planning

Transfer of Wealth

Will and Estate Planning

Retirement Planning

Polly – Moving forward with the right financial plan

Empowering Polly to achieve financial success

When Polly moved to Canada, she was determined to build a great life for her family. Years of hard work and resilience paved the way for success, but when faced with the unthinkable, Polly was left to start again, leaving her with feelings of uncertainty. Find out how with the help of her TD Wealth advisor and a personalized financial plan Polly was able to take charge of her family’s financial future.

When Polly moved to Canada, she was determined to build a great life for her family. Years of hard work and resilience paved the way for success, but when faced with the unthinkable, Polly was left to start again, leaving her with feelings of uncertainty. Find out how with the help of her TD Wealth advisor and a personalized financial plan Polly was able to take charge of her family’s financial future.

Nick & Justina – Business owners teaming up with TD Wealth

Putting finances into perspective

As small business owners, Nick and Justina make a powerhouse team, supporting each other through ups and downs. As parents, they worry about how potential challenges with the business could impact their family’s future. Nick and Justina teamed up with their TD Wealth advisor to build a personalized financial plan. With a plan in place, they finally saw that achieving their family’s goals while maintaining the business was possible. Find out how the right financial advice helped give them a brighter view of life.

As small business owners, Nick and Justina make a powerhouse team, supporting each other through ups and downs. As parents, they worry about how potential challenges with the business could impact their family’s future. Nick and Justina teamed up with their TD Wealth advisor to build a personalized financial plan. With a plan in place, they finally saw that achieving their family’s goals while maintaining the business was possible. Find out how the right financial advice helped give them a brighter view of life.

Tailored Solutions

Our solutions can help people meet their unique needs and make them feel more confident in their financial future.

Your unique goals

You've worked hard to get where you are today. Now's the time to maintain, grow, and protect your net worth. Get tailored advice, solutions, and strategies that can help achieve your goals.

Trending Articles

Stay informed and enhance your investment knowledge with our curated articles on the latest news, strategies and insights.

How the U.S. election may play out and what it means for markets

Article

How the U.S. election may play out and what it means for markets

As the U.S. election draws closer, investors will be focused on the potential outcomes and what it could mean for markets. MoneyTalk’s Greg Bonnell discusses with Kevin Hebner, Global Investment Strategist with TD Epoch.

As interest rates decline, is now the time to consider dividend stocks?

Article

As interest rates decline, is now the time to consider dividend stocks?

Joint accounts can be a convenient tool between spouses or to help a senior parent manage finances. But what happens when a joint account is used as an estate planning strategy?

When do you have to pay capital gains tax on gifts?

Article

When do you have to pay capital gains tax on gifts?

Planning on leaving a large gift to your children or grandchildren? If it includes property or securities, there may be tax implications to keep in mind. Nicole Ewing, Director, Tax and Estate Planning, TD Wealth, joins Greg Bonnell to discuss what Canadians should know and ways you may be able to reduce the tax impact.