Published: July 1, 2025

With recent property tax assessments in the mail, many people have seen large increases to their home values. We often hear "You can't lose with real estate." or "Real estate is a better investment than the stock market." While at certain points in time this may be true, over the long run you might be surprised how they have played out.

Before we go any further, we feel it is important to mention that we are believers in real estate. Between our families, we own residential, rental, and recreational.

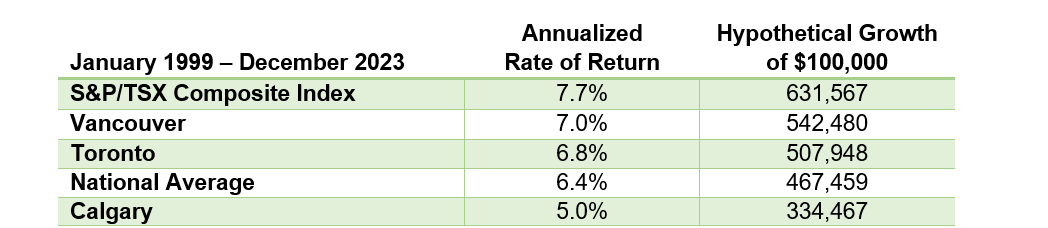

The chart below compares real estate returns from January 1999 to December 2023 in several Canadian cities versus the Canadian stock market. Stock market returns do not include investment fees or taxes. Real Estate returns do not factor in rental income or home ownership costs such as mortgage, insurance, upkeep, property transfer tax, legal fees, or property tax.

What About Kamloops Real Estate?

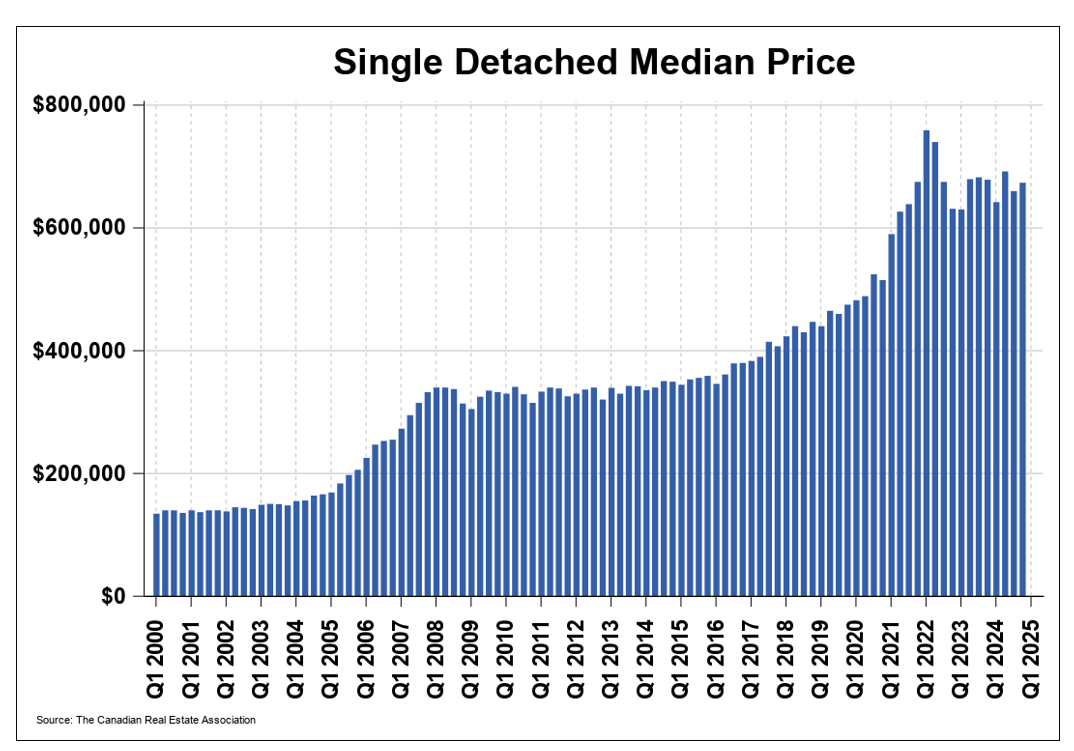

We found data on The Canadian Real Estate Association (CREA) website going back to 2000 for Kamloops. Our city has benefited from solid real estate gains in the recent years.

Interesting point: The Kamloops average sale price peaked in 2022 for single family detached homes. The median sale price only saw a small change in 2024, down 0.7% on a year over year basis. Stats show the average sale price at $673,600 in the fourth quarter of 2024.

So, why the difference in psychology between stocks and real estate? Maybe it is because real estate is tangible. You can see it, walk through it, and have the keys that go with it. Perhaps it's because you can sell a stock in just a few clicks, whereas real estate has a longer sale process. Potentially the costs of buying and selling real estate deter investors from selling in a panic. In the end, the objective is the same. To invest in assets that will grow over the long term and increase your wealth.

We like to remind all investors that:

- We believe owning a home is financially prudent.

- A home is often ones' largest portion of their net worth, this is why we encourage investors to diversify.

- Historically the Canadian and US stock markets have outperformed real estate.

- During certain periods, there can be over or underperformance from any of these three assets.

Until next time, Invest Well. Live Well.

Written by Keith