Published: February 1, 2025

This is one of the most frequent questions we get from prospective retirees in our office. Choosing a suitable withdrawal or “burn rate“ from your portfolio can be the single most important factor affecting your nest egg. The right withdrawal rate can ensure your money lasts at least as long as you do. Lifespan, inflation and market returns are all beyond your control; however, your asset allocation and withdrawals are well within it.

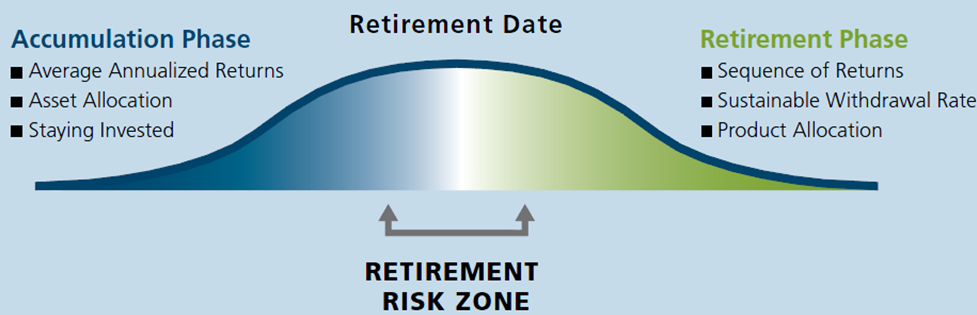

As you approach retirement, it is critical that your portfolio is adjusted for the income phase. Prior to retirement the focus was on accumulation. During the accumulation phase, poor returns early could be offset by greater returns at a later date, allowing the market to grow your retirement investments. Once retired, most people rely on a constant withdrawal rate from their portfolio to fund their lifestyle.

Typically, the 5-10 years on either end of your retirement date are known as the “retirement risk zone”, during which you are more sensitive to portfolio shocks. If a portfolio experiences a sharp decline combined with withdrawals, it can permanently impair your wealth and retirement. We feel the best solution for the unpredictable nature of the stock market is to following a defined process:

- Set aside a contingency

- Build a diversified portfolio

- Limit withdrawals

Source: Manulife Investment Management

We often encourage investors to have one to three years' worth of needs set aside in low-risk investments. For example, if you require $20,000 a year from your portfolio, there could be $60,000 set aside in bonds or Guaranteed Investment Certificates (GICs). In the event of a market downturn, the portfolio can be left to recover and the contingency that was set aside can be used to maintain one’s lifestyle.

Traditionally, asset allocation meant what percentage you have in equities (stocks) and income (bonds). An old guideline suggested portfolios should have one's age in bonds. For example: If you are 60 years old, then 60% should be in bonds versus if you are 40 years old, you could have 40% in bonds while the remainder of the portfolio would be invested in equities. These were merely quick guides that were developed when interest rates were much higher and didn't factor in any other personal circumstances.

Asset allocation can have an impact on the performance of your portfolio throughout your retirement. A portfolio that is too conservative will risk not keeping up with inflation and might not meet long term needs, while leaning into a strategy that is too aggressive can risk depleting capital at a time a retiree can least afford it.

William Bergen, a financial pioneer, calculated that investors can safely withdrawal 4% from a balanced portfolio (60% stock + 40% bonds) in the first year and increase annually with inflation. Bergen's theory, also called the Safemax, had proven this 4% withdrawal rate was sustainable over every 30-year period since 1926.

FP Canada regularly publishes financial planning assumptions and guidelines. As of April 2024, they project that traditional 60% stock/40% bond portfolio is forecast to return 5.2% before fees.

The bottom line is despite many methodologies, we feel retirees should always build a retirement plan customized to their specific circumstance and needs. Over the last 20 years, we have built a customized Retirement Roadmap process that helps illustrate how much cash flow retirees will likely have after-tax. In addition, we may determine that you only require a 3% return to help meet your goals and thus recommend a portfolio with typically less risk. After all, if you can meet your goals why take more risk?

Until next time...

Invest Well. Live Well

Written by Eric