Published: December 1, 2025

For many of us, giving is an important part to help build a better society. Our team is passionate about philanthropy and generally there are three ways people can give:

- Time (volunteering)

- Talent (sitting on a Board or committee)

- Treasure (donating cash or an investment)

Since 2015, our clients collectively have donated in excess of $6.1 million! These funds have gone to so many worthwhile causes like cancer, education, pets, hospitals, hospice, Alzheimer's, food banks, churches and many more. We stay on top of this for our clients to help ensure they are maximizing all their tax credits1.

Canadian income tax brackets typically range between 20%-54%. B.C. residents who have donated more than $200, can receive total charitable tax credits of approximately 45.8%. Furthermore, if you donate a profitable investment in-kind, you may be entitled to a zero-inclusion rate on any capital gains realized.

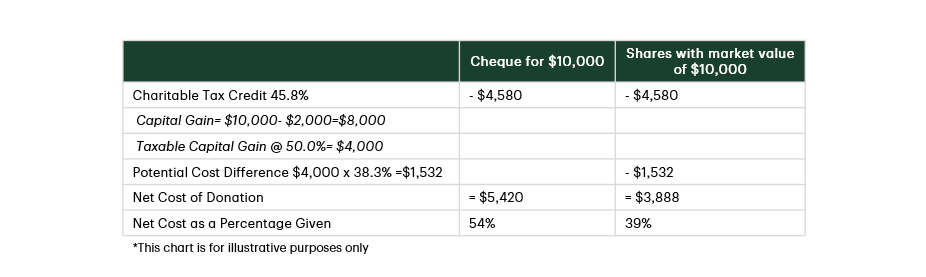

Here is an example of a B.C. donor with a net income of over $100,000 who has already donated $200 and would like to make another donation in the amount of $10,000. They have the choice of a writing a $10,000 cheque or donating their shares that have appreciated in value to $10,000 from their original cost (adjusted cost base) of $2,000.

You may be surprised to learn that your actual out of pocket costs are significantly less than the actual donation amount. Even if the example was applied to an individual with a lower income for tax purposes, there may still be a savings by donating in-kind. It is worth adding that donating cash or appreciated securities may also be a benefit to a business or holding company. Please consult your tax advisors for information specific to your situation.

We hope to help each of you achieve your goals in the most tax efficient way which may involve philanthropic giving.

1www.kpmg.com

Until next time...

Invest Well. Live Well.

Written by Eric