Dan Yanke

Phone

Office Location

Following graduation from the University of Guelph with an Honors Marine and Freshwater Biology degree and a minor in Business Administration, he owned and managed multiple companies. His passion, however, was with the stock market, so he began managing money for his friends and family. For the past 8 years he has worked in the brokerage industry managing money for a vast array of clients. In 2014, Dan completed the rigorous training for the Chartered Investment Manager (CIM®) designation.

His technical expertise in investment management and economics provides him with the foundation to his holistic approach to wealth management. He tailors investment strategies to complement clients life goals and business objectives, as well as estate and charitable-giving intentions.

Dan understands that each client’s wealth management vision is unique and takes a personal approach to every relationship he builds. Trust and integrity are fundamental characteristics of his practice.

Away from the office Dan spends much of his time with his wife Jaime, daughter Kensington and son Langdon. He is active in the community as a member of the Kitchener Grand River Rotary Club, a committee member and session leader of Camp Enterprise, an entrepreneurship opportunity for high school kids, and an active athlete playing hockey, squash, golf and Ultimate Frisbee for Team Canada.

Ewald, Yanke and Associates Wealth Management is a part of TD Wealth Private Investment Advice, a division of TD Waterhouse Canada Inc. which is a subsidiary of The Toronto-Dominion Bank.

Phone

Fax

(519) 725-5806

Certificates

B.Sc. (Hons)

CIM®

Deeply Talented Team

Drawing on this deep talent, as well as the expertise of various TD Specialists, we can provide you with a range of strategic planning services that is often only seen in family office environments.

Simply put, we are professionals.

Helping achieve what truly matters to you and your family.

Build net worth: We can help you build your net worth by developing effective strategies and investment solutions that align to your needs, even as they evolve.

Protect what matters: By leveraging the expertise of TD specialists, we can integrate strategies to help you protect what matters to you most at every life stage.

Implement tax-efficient strategies: We can work with you to help create and structure your accounts to help reduce tax exposure while keeping income available for when you need it.

Leave a legacy: Your legacy is important to us. We’ll help you create a plan that provides for your top priorities and optimizes the transfer of your wealth.

Personalized Portfolio Asset Allocation

Depending on your stage in life you may be focusing on growing your wealth, protecting your wealth, or transferring your wealth; we align your portfolio to your current objectives and adjust it as your objectives change.

Pension-Like Portfolio Design

We do too.

Market volatility is inevitable. However, our portfolio is designed to help grow assets responsibly in up markets, while aiming to provide improved downside protection during challenging markets.

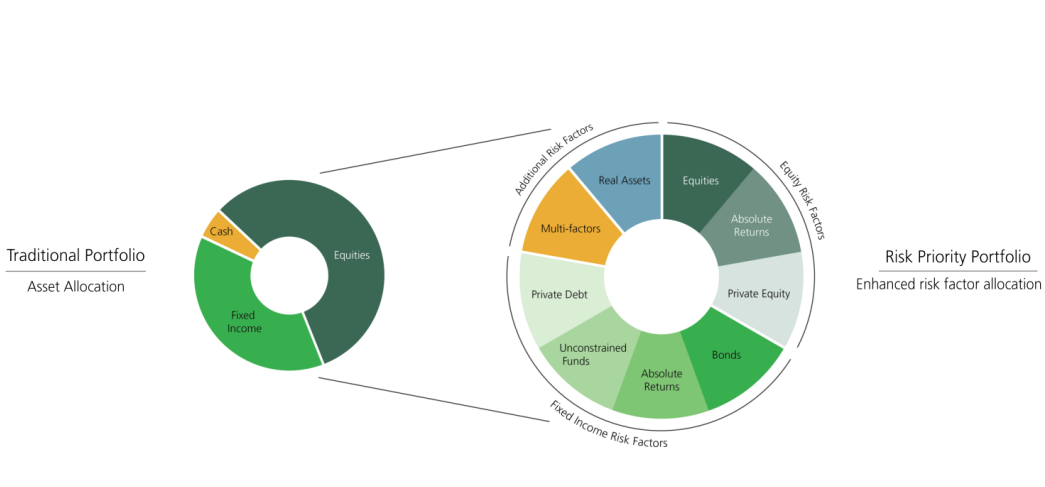

Gone are the days where the traditional 60/40 portfolio will continue to be effective. We think about new ways to manage your money for today and the future.

Strategically, the portfolio is diversified into several asset classes and geographical locations. The asset classes include public and private equity, public and private debt, hard assets and alternative assets. Geographically, we allocate money to Canada, the US, Europe, Asia and Emerging Markets.

Tactically, we monitor and, when deemed appropriate, change the portfolio's geographical weightings, asset class weightings, investment constituents or foreign exchange hedges to capitalize on market, sector or company corrections.

For clients with low liquidity needs we take advantage of illiquidity premiums by allocating a portion of the portfolio to alternative investments such as private debt, equity and real estate – just like pension funds do.

Trending Articles

Stay informed and enhance your investment knowledge with our curated articles on the latest news, strategies and insights.

Estate planning basics

Article

Estate planning basics

An estate plan can help ensure your wishes are fulfilled if you become incapacitated and when you pass away. Here’s what you should know about building one.

Buying a home on your own: Ideas for a challenging market

Article

Buying a home on your own: Ideas for a challenging market

Despite ongoing affordability issues, almost half of first-time homebuyers say they want to apply for a mortgage on their own. If you're one of them, here are a few ideas to help you get started.

Mark Carney leads Liberals to victory: Now what?

Article

Mark Carney leads Liberals to victory: Now what?

Mark Carney and his Liberal Party have won a fourth term in Canada’s federal election. The new Carney-led government will take the helm amid ongoing political and economic uncertainty. MoneyTalks’ Kim Parlee speaks with Frank McKenna, Deputy Chair, Wholesale Banking at TD Bank Group and Beata Caranci, Chief Economist with TD, about the election results, relations with the U.S., and the road ahead for Canada’s economy.