Ben Foster

Phone

Office Location

Biography

Beginning my career in equity research at an international brokerage firm, I have spent the last 20 years helping high-net-worth families and business owners in the St. Albert and surrounding communities reach their personal and financial goals. Raised in St. Albert, I work and live in the community alongside my wife and two children. I am active in sports, love to travel and give back to my community as a member of the St. Albert Cosmopolitan Club. I hold a Bachelors degree in Commerce from the University of Alberta and the CERTIFIED FINANCIAL PLANNER™ certification offered by FP Canada.

Certificates

B.Comm.

CFP®

FCSI®

Education

B Comm - University of Alberta

Our Services

Retirement Planning

Investment Planning

Will and Estate Planning

Multi-Generational Family

Disciplined Approach

Four Financial Pillars

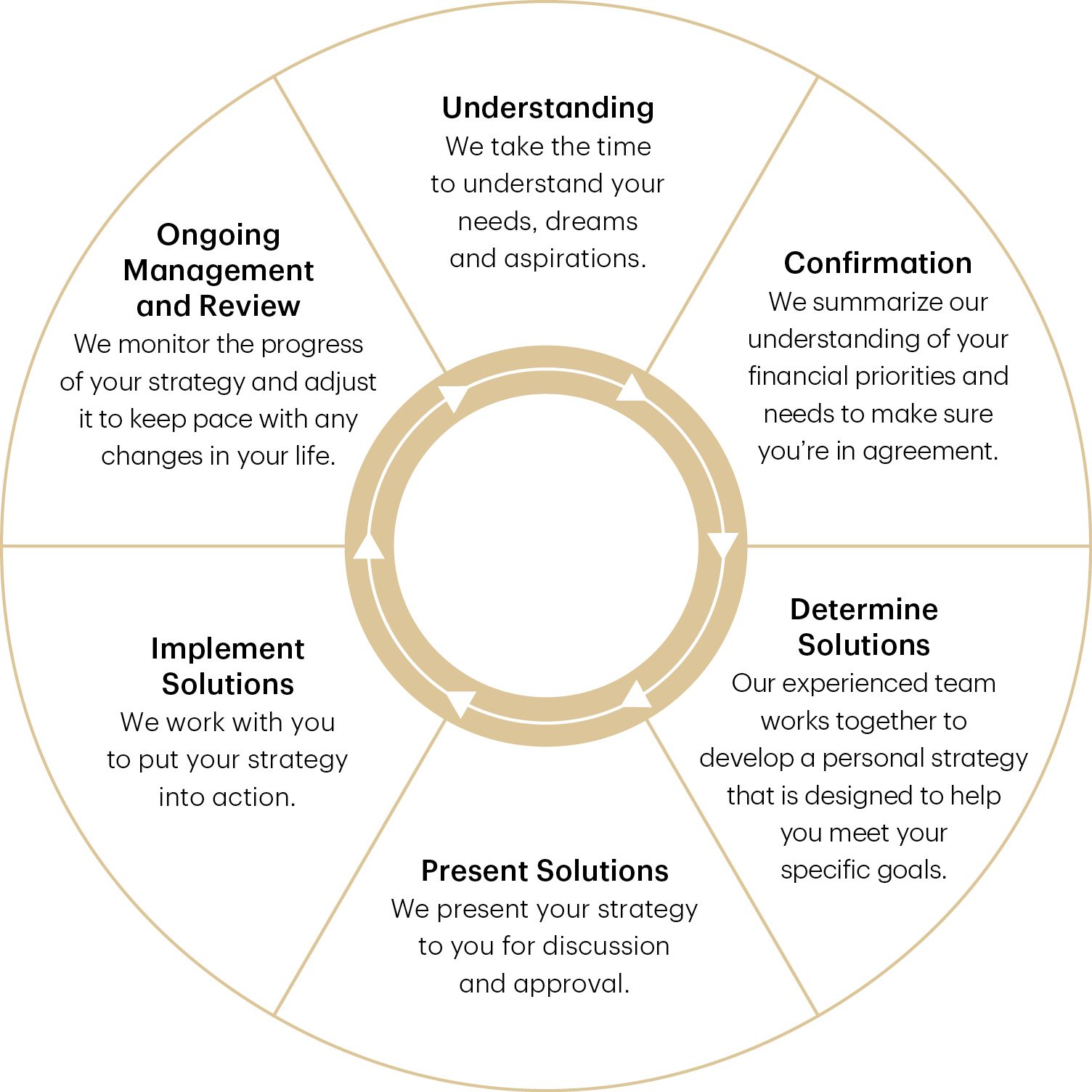

The Planning Process

Tailored Investment Solutions

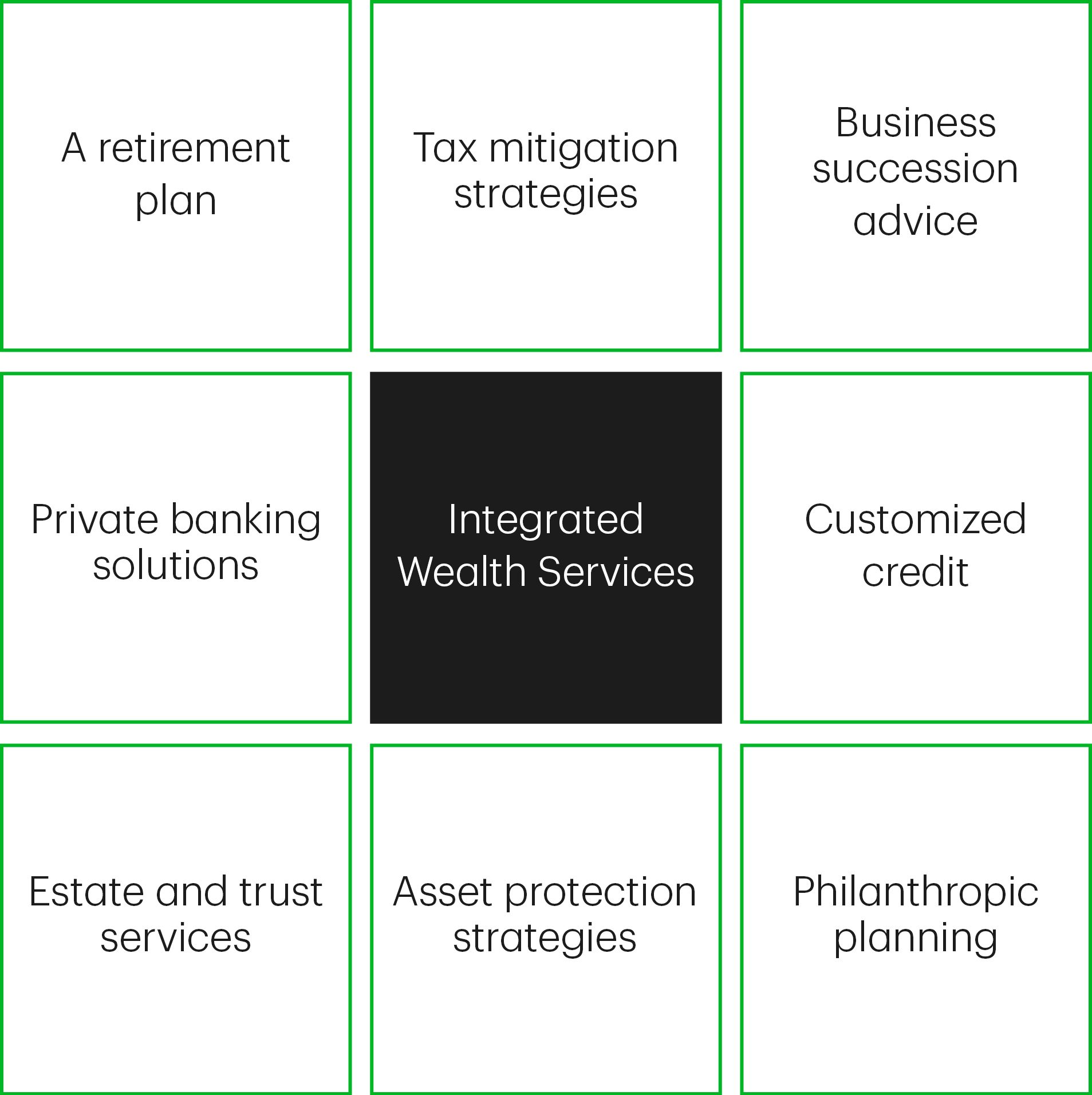

We believe investing should reflect your unique needs — your lifestyle, your values, and your long-term goals. Our disciplined, research-driven investment philosophy is designed to help protect and grow wealth in all market conditions, while supporting your broader financial plan.

Here’s what you can expect:

- A personalized strategy aligned with your life goals

- Ongoing monitoring and proactive adjustments

- Portfolio design that manages risk while pursuing growth

- Full integration with tax and estate planning strategies

Your unique goals

You've worked hard to get where you are today. Now's the time to maintain, grow, and protect your net worth. Get tailored advice, solutions, and strategies that can help achieve your goals.